Exhibit 99.1

PROGRESSIVE GAMES PARTNERS -

ACQUIRED INTEREST

CARVE OUT FINANCIAL STATEMENTS

DECEMBER 31, 2019

Exhibit 99.1

Contents

Page

Report Of Independent Registered Public

Accounting Firm1 - 2

Financial Statements

Carve Out Balance Sheet3

Carve Out Statement Of Operations4

Carve Out Statement Of Acquired Members’ Equity5

Carve Out Statement Of Cash Flows6

Notes To Carve Out Financial Statements7 - 13

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders of

Galaxy Gaming, Inc.

Opinion on the Financial Statements

We have audited the accompanying balance sheet of Progressive Games Partners – acquired interest, A carve-out of Progressive Games Partners, LLC (the “Company”), as of December 31, 2019, and the related carve-out statements of operations, changes in acquired members’ equity and cash flows for the year ended December 31, 2019 and the related notes (collectively referred to as the “carve-out financial statements”). In our opinion, the carve-out financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2019, and the results of its operations and its cash flows for the year ended December 31, 2019, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These carve-out financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these carve-out financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The company is not required to have, nor were we engaged to perform, an audit of the Company’s internal control over financial reporting. As part of our audit we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

To the Board of Directors and Shareholders of

Galaxy Gaming, Inc.

As discussed in Note 1, Progressive Games Partners LLC is a subsidiary of Progressive Games Licensing LLC and parent company to its subsidiaries, Games Marketing Limited, Felt Limited, and Mine International Limited. The carve-out financial statements of the Progressive Games Partners LLC reflect the assets, liabilities, revenue and expenses directly attributable to Progressive Games Partners LLC, not including any subsidiaries’ financial information, to present the carve-out financial position, results of operations, changes in acquired members’ equity and cash flows of Progressive Games Partners LLC on a stand-alone basis and do not necessarily reflect the carve-out financial position, results of operations, changes in stockholders’ equity and cash flows of Progressive Games Partners LLC in the future or what they would have been had the Progressive Games Partners LLC been a separate, stand-alone entity during the periods presented. Our opinion is not modified with respect to this matter.

On February 25, 2020, Galaxy Gaming, Inc., completed a membership interest purchase agreement with Progressive Games Partners LLC, a subsidiary of Progressive Games Licensing LLC, in accordance with the terms of the First Amendment to Membership Interest Purchase Agreement dated as of August 21, 2020. Following the completion of the Progressive Games Partners LLC purchase, the business conducted by Progressive Games Partners LLC became the business conducted by Galaxy Gaming, Inc.

We have served as the Company’s auditor since 2020.

/s/ RBSM LLP

Henderson, NV

December 16, 2021

Page 2

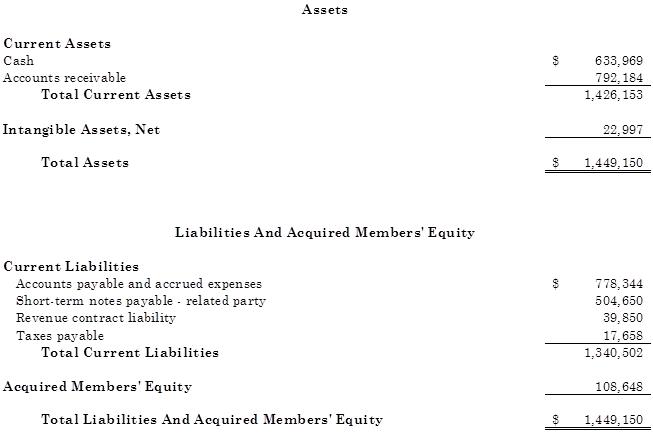

PROGRESSIVE GAMES PARTNERS - ACQUIRED INTEREST

December 31, 2019

See the notes to the carve out financial statements.Page 3

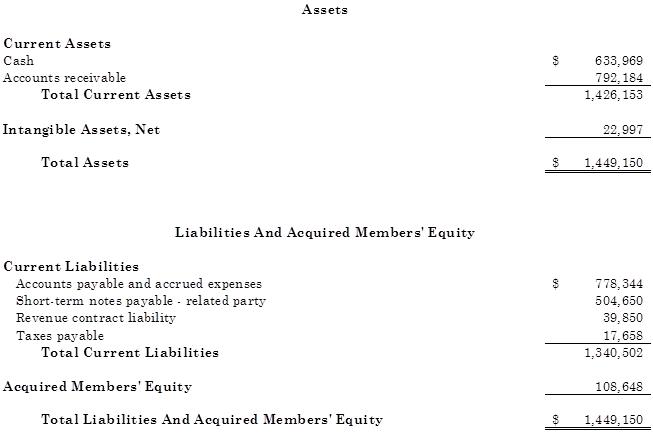

PROGRESSIVE GAMES PARTNERS - ACQUIRED INTEREST

CARVE OUT STATEMENT OF OPERATIONS

For The Year Ended December 31, 2019

See the notes to the carve out financial statements.Page 4

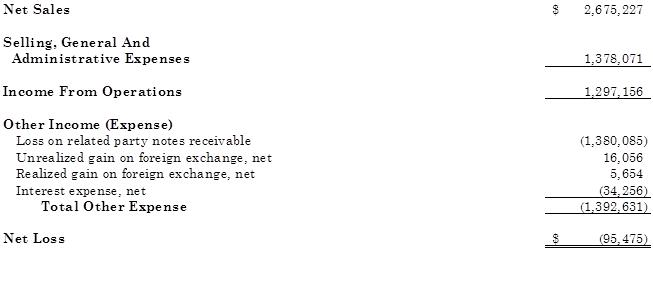

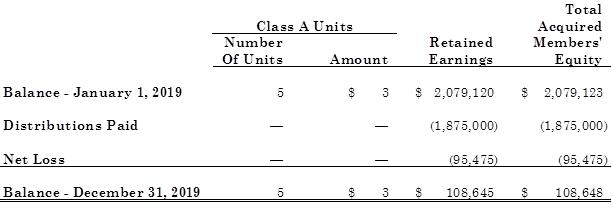

PROGRESSIVE GAMES PARTNERS - ACQUIRED INTEREST

CARVE OUT STATEMENT OF ACQUIRED MEMBERS’ EQUITY

For The Year Ended December 31, 2019

See the notes to the carve out financial statements.Page 5

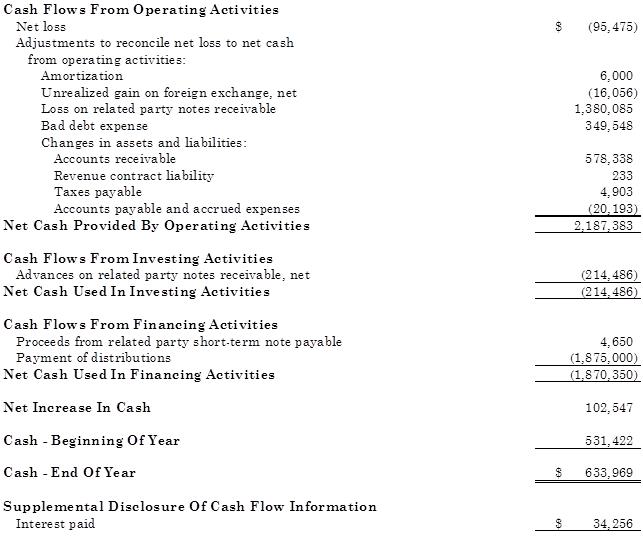

PROGRESSIVE GAMES PARTNERS - ACQUIRED INTEREST

For The Year Ended December 31, 2019

See the notes to the carve out financial statements.Page 6

PROGRESSIVE GAMES PARTNERS - ACQUIRED INTEREST

NOTES TO CARVE OUT FINANCIAL STATEMENTS

December 31, 2019

|

1. |

Summary Of Significant Accounting Policies |

Organization

Progressive Games Partners LLC (the Company) was organized and registered in the Isle of Man on October 8, 2003 under the Limited Liability Companies Act of 1996. The Company has a single class of membership interests. The members are not liable for the debts, obligations or liabilities of the Company.

Basis Of Presentation

On August 21, 2020, Galaxy Gaming, Inc. (Galaxy) acquired 100% of the membership interests of the Company (the Acquisition). The Acquisition did not include the Company’s ownership interests in the following entities: Mine International Limited, Felt Limited, Games Marketing Limited and Jingle Prize, Inc. (the Excluded Subsidiaries). Throughout the period covered by these carve out financial statements, the Company did not consolidate the Excluded Subsidiaries.

Consequently, consolidated financial statements historically have not been prepared. As such, the Company has prepared the accompanying carve out financial statements as of and for the year ended December 31, 2019. These financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America from the historical accounting records of the Company without regard to the Excluded Subsidiaries. All results of operations, assets, and liabilities of the Company, except those of the Excluded Subsidiaries, are reflected in these carve out financial statements.

Page 7

PROGRESSIVE GAMES PARTNERS - ACQUIRED INTEREST

Notes To Carve Out Financial Statements (Continued)

The Company considers cash on hand, cash in banks, certificates of deposit, and other short-term securities with maturities of three months or less when purchased, as cash and cash equivalents. All of the Company’s cash is held in institutions outside of the United States.

Accounts Receivable

Accounts receivable are stated at face value less an allowance for doubtful accounts. Accounts receivable are non-interest bearing. The Company reviews the accounts receivable on a monthly basis to determine if any receivables will potentially be uncollectible. The allowance for doubtful accounts is estimated based on specific customer reviews, historical collection trends and current economic and business conditions. Management believes that no allowance is necessary as of December 31, 2019.

Other Intangible Assets, Net

Other intangible assets consist primarily of acquired rights to games, which have a finite life and are being amortized using the straight-line method over estimated economic lives of 10 years.

Other intangible assets are analyzed for potential impairment whenever events or changes in circumstances indicate the carrying value may not be recoverable and exceeds the fair value, which is the sum of the undiscounted cash flows expected to result from the use and eventual disposition of the intangible assets. There were no events or changes in circumstances that would indicate a possible impairment as of December 31, 2019.

Revenue Recognition

The Company generates revenue primarily from the licensing of the Company’s intellectual property.

The Company derives royalty revenue from both fixed fee and sales-based recurring license fee agreements. The Company accounts for these agreements as month-to-month contracts and recognizes revenue each month as the Company satisfies performance obligations by granting access to intellectual property to clients. The Company has determined that it is the principal in transactions where it is the owner of the licensed intellectual property. The Company is the agent in transactions where it licenses intellectual property that it does not own. This revenue is presented net of the related royalty payments. For the year ended December 31, 2019, royalties of $2.3 million were included as a reduction of net sales in the statement of operations.

Page 8

PROGRESSIVE GAMES PARTNERS - ACQUIRED INTEREST

Notes To Carve Out Financial Statements (Continued)

Foreign Currency Transactions

The Company’s functional currency is the U.S. Dollar. The Company records foreign currency transactions at the exchange rate prevailing at the date of the transaction. Subsequent exchange gains and losses from foreign currency remeasurements are included in other income (expense) of the Company’s carve out statement of operations.

Use Of Estimates And Assumptions

The Company is required to make estimates, judgments and assumptions that the Company believes are reasonable based on the Company’s historical experience, contract terms, observance of known trends in the Company and the industry as a whole and information available from other outside sources. The Company’s estimates affect reported amounts for assets, liabilities, revenues, expenses and related disclosures. Actual results may differ from initial estimates.

New Accounting Standards Not Yet Adopted

Financial Instruments - Credit Losses

In February 2020, the FASB issued ASU No. 2020-02, Financial Instruments -Credit Losses (Topic 326). ASU 2020-02 provides updated guidance on how an entity should measure credit losses on financial instruments and delayed the effective date of Topic 326 for certain small public companies and other private companies until fiscal years beginning after December 15, 2023. Early adoption is permitted. The Company does not believe the adoption of this guidance will have a material impact on the Company’s financial statements.

|

2. |

Revenue Recognition |

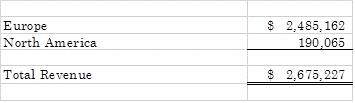

Disaggregation Of Revenue

The following table disaggregates the Company’s revenue by geographic location for the year ended December 31, 2019:

Page 9

PROGRESSIVE GAMES PARTNERS - ACQUIRED INTEREST

Notes To Carve Out Financial Statements (Continued)

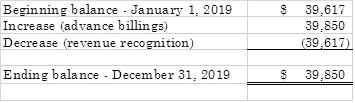

The Company invoices certain clients monthly in advance for unlimited use of the Company’s intellectual property licenses and recognizes a revenue contract liability that represents such advanced billing to the Company’s clients for unsatisfied performance obligations. The Company reduces the revenue contract liability and recognizes revenue when the Company transfers those goods or services and, therefore, satisfies the Company’s performance obligation.

The table below summarizes changes in the revenue contract liability during year ended December 31, 2019:

Revenue recognized during the year ended December 31, 2019 that was included in the beginning balance of revenue contract liability above was $39,617.

|

3. |

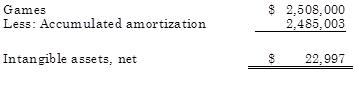

Intangible Assets |

Intangible assets, net consisted of the following at December 31, 2019:

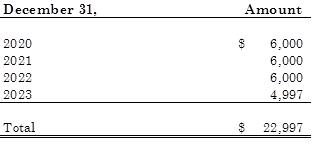

For the year ended December 31, 2019, amortization expense related to the finite-lived intangible assets was $6,000.

Page 10

PROGRESSIVE GAMES PARTNERS - ACQUIRED INTEREST

Notes To Carve Out Financial Statements (Continued)

Estimated future amortization expense is as follows:

|

4. |

Notes Payable |

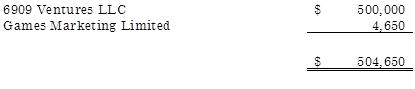

Notes payable consisted of the following at December 31, 2019:

The note payable to 6909 Ventures LLC is subject to interest of $7,500 per quarter and is repayable on demand. In July 2020, the note was repaid in full.

Games Marketing Limited is a wholly-owned subsidiary of the Company. The note payable to Games Marketing Limited is unsecured, interest free, and repayable on demand.

|

5. |

Related Party Transactions |

During 2019, the Company paid $682,913 to Games Marketing Limited in respect of agency fees. As of December 31, 2019, $528 due from Games Marketing Limited was included in accounts payable and accrued expenses.

During 2019, revenue of $19,817 was earned from Felt Limited, a company related through ownership.

During 2019, fees of $168,930 were paid direct to Boston Limited, a company with common ownership, in respect of professional services provided. As of December 31, 2019, $15,755 owed to Boston Limited was included in accounts payable and accrued expenses.

Page 11

PROGRESSIVE GAMES PARTNERS - ACQUIRED INTEREST

Notes To Carve Out Financial Statements (Continued)

During 2019, the Company wrote off two related-party notes receivable totaling $1,380,085 that it had determined were uncollectible.

|

6. |

Commitments And Contingencies |

Concentration of risk. The Company is exposed to risks associated with clients who represent a significant portion of total revenues and accounts receivable. For the year ended December 31, 2019, revenue from two customers represented 81% of the Company’s total revenue. Accounts receivable from these two customers represented 69% of total accounts receivable as of December 31, 2019.

Approximately 85% of the Company’s revenues are generated from games licensed from eight entities.

|

7. |

Income Taxes |

The Company is a limited liability company, and as such, is not subject to entity level income taxes. All taxable income and losses are passed through to the individual members. The Company follows accounting rules for uncertain tax positions. These rules require financial statement recognition of the impact of a tax position if a position is more likely than not of being sustained on audit, based on the technical merits of the position. These rules also provide guidance on measurement, derecognition, classification, interest and penalties, and disclosure requirements for uncertain tax positions. All federal and state tax returns remain subject to examination by taxing authorities.

Page 12

PROGRESSIVE GAMES PARTNERS - ACQUIRED INTEREST

Notes To Carve Out Financial Statements (Continued)

The Company evaluates subsequent events through the date of issuance of the financial statements. There have been no subsequent events that occurred during such period that would require adjustment to or disclosure in the financial statements as of and for the year ended December 31, 2019 except as follows:

Purchase Transaction

On February 25, 2020, the Company and Galaxy entered into a Membership Interest Purchase Agreement (the MIPA), pursuant to which Galaxy agreed to acquire 100% of the equity interests in the Company for $12.425 million. Of the consideration, at least $6.425 million but no more than $10.425 million was to be paid in cash; any amounts not paid in cash were to be paid in newly issued shares of Galaxy’s common stock valued at $1.91 per share.

On August 21, 2020, the Company and Galaxy entered a First Amendment to the MIPA (the First Amendment). Pursuant to the First Amendment, the Company and Galaxy agreed that the cash component of the purchase price would be $6.425 million and that the stock component would be satisfied through the issuance of 3,141,361 shares of Galaxy common stock. The purchase was completed on August 21, 2020.

For the year ended December 31, 2019, royalties to Galaxy of approximately $900,000 were included as a reduction of net sales. As of December 31, 2019, $453,550 due to Galaxy was included in accounts payable and accrued expenses on the balance sheet.

Page 13