|

· Secured Diversified Investment, Ltd. (OTC-BB: SECD.OB), acquired Galaxy Gaming, Inc. via a reverse merger on 2/10/09.

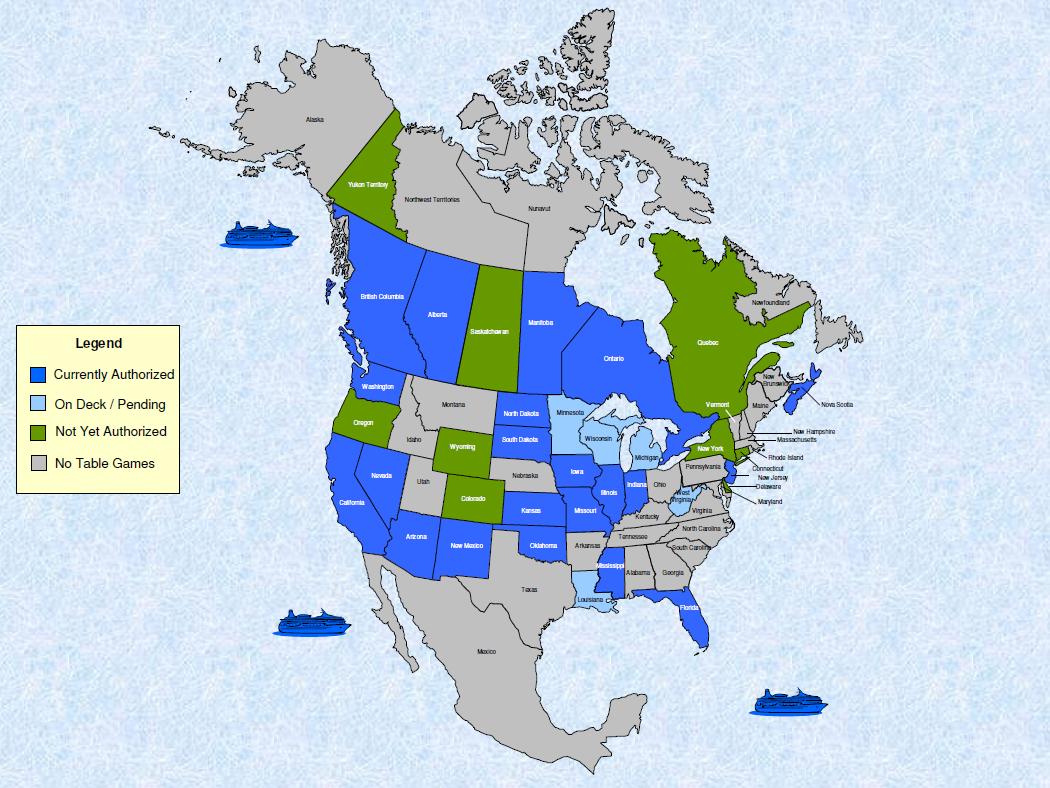

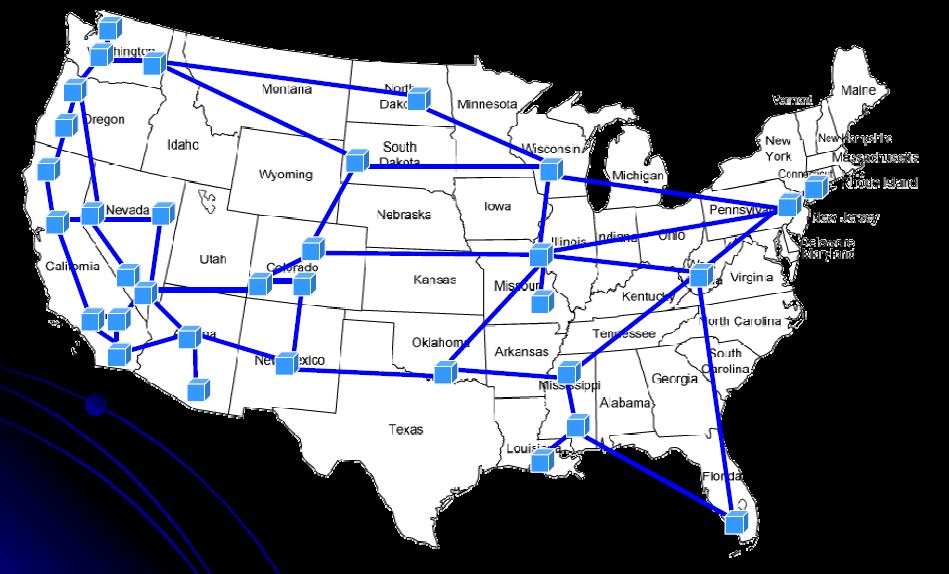

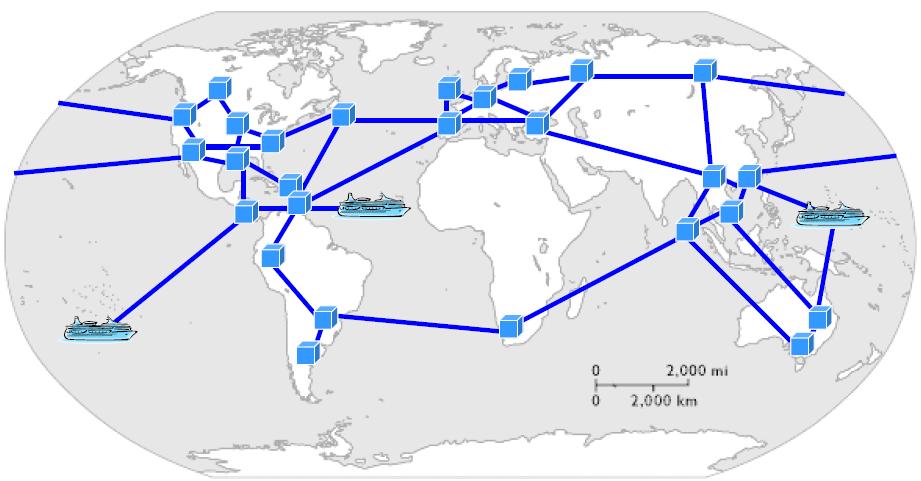

· Galaxy Gaming, Inc. is a leading developer of casino table games and enhanced electronic table game platforms and wagering systems. We design, engineer, market and distribute our products and services throughout North America and

on cruise ships worldwide.

· We own global rights to popular table game content, such as Lucky Ladies, Texas Shootout and Emperor’s Challenge. We also have developed innovative table game platforms known as the Bet Tabulator System, TableVision and the

Bonus Jackpot System and have numerous other products under development.

· We receive high-margin recurring revenue derived from royalties related to the licensing of our intellectual property and have experienced strong growth (30% annual) during the current economic crisis.

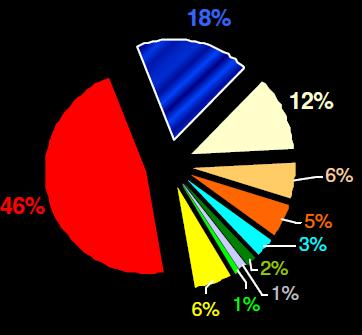

· Business started from scratch in 1997 and was built by frugally reinvesting cash flow. We now occupy the #2 market position with 18% of the competitive market. We have 12 employees.

· We are profitable. |

|

|

· |

Robert Saucier - Founder & CEO |

|

o |

Founder and operator of numerous successful start-up ventures including International Pacific, an INC 500 company. |

|

· |

Bill O’Hara – COO |

|

o |

Started competitor Shuffle Master Gaming and built it from the ground up. Subsequently, he played major roles at Casinovations and PDS Gaming. |

|

· |

Bob Pietrosanto - Sales Manager |

|

o |

Former Shuffle Master and Casinovations executive well known throughout the industry with both domestic and international sales management experience. |

|

· |

Dan Evans - Technology Development Manager |

|

o |

Sales and technology executive at various prominent high-tech companies including Sun Microsystems Zynx Networks. |

|

· |

Dan Scott - Chief Financial Advisor |

|

o |

Formerly CFO for Caesars Palace and MGM. |

|

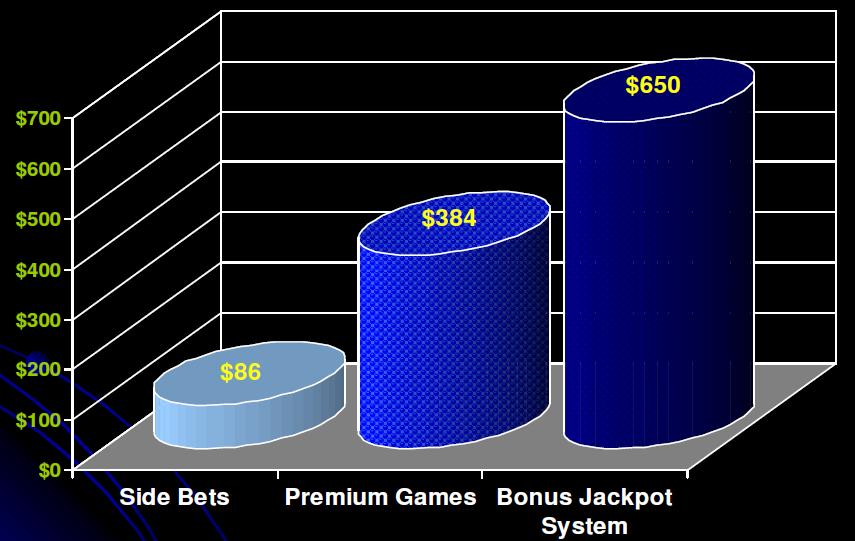

Product Benefits |

|

|

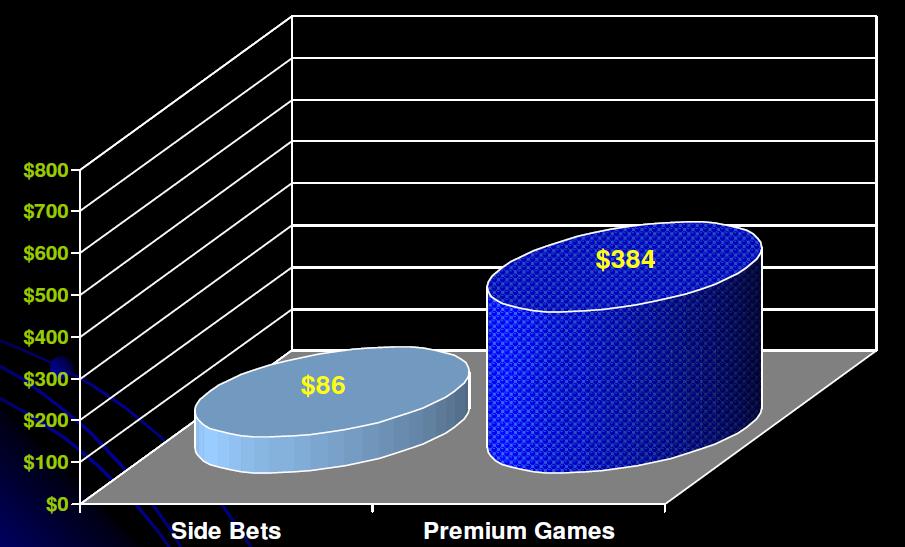

Side Bets |

Premium Games | |||

|

|

|

| |

|

|

|

| |

|

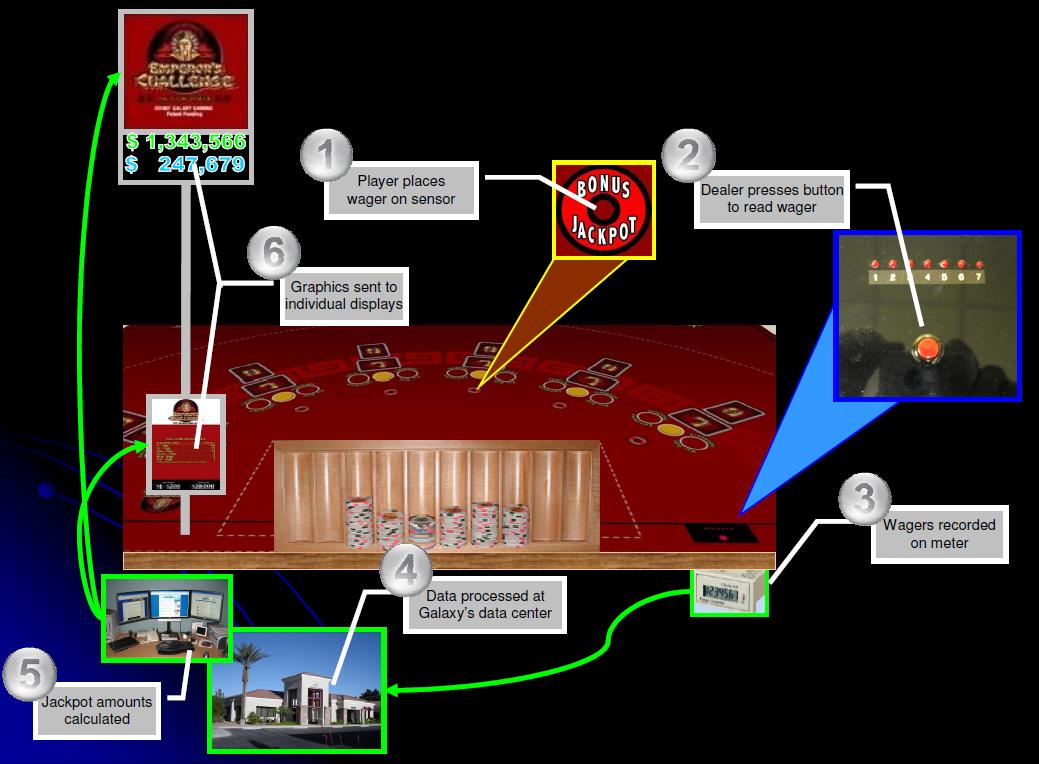

· Similar, but yet superior to a traditional Progressive Meter System.

· Able to fund a

“LIFE ALTERING JACKPOT”.

· Advantages:

o Players enjoy the additional Bonusing options.

o Increased play and profitability for the casino operator.

o Less expensive than competing products.

o “Multi-Casino BJS network” may be installed for a fraction of the cost of a traditional Wide Area Progressive system. |

|

|

1. |

Equipment Sale (e.g. $1,300 one time) |

|

2. |

Content Licensing (e.g. $495 per month) |

|

3. |

Performance Based Pricing (e.g. 2 a wager) |

|

4. |

Jackpot Fund Maintenance Fee i.e. Banking (Future) |

|

5. |

Advertising (Future) |

|

1. |

Build our recurring revenue base. |

|

· |

Despite the current economy, or maybe because of it, our products are in their highest demand. Accordingly, we must capture as much market share possible – NOW! |

|

2. |

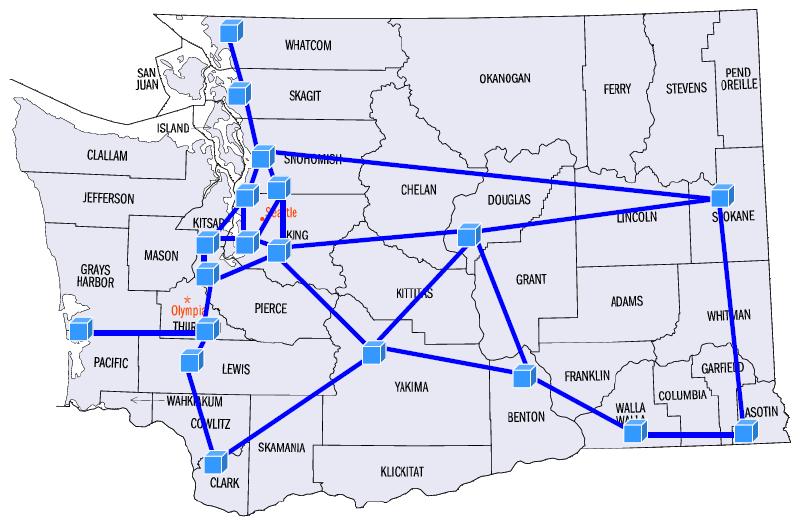

Expand our distribution network. |

|

· |

Obtain regulatory approval in additional jurisdictions. (e.g. Louisiana, W. Virginia, Delaware) |

|

· |

Increase the size and performance our sales force. (2 additional reps, mobile showroom) |

|

3. |

Increase our per unit price point. |

|

· |

Develop or acquire new premium proprietary game content to command higher royalties. |

|

· |

Continue to develop, manufacture and install our Bonus Jackpot System. |

|

4. |

Stay profitable. |

|

· |

Although we seek rapid expansion, we must guard our profits and cash flow. |

|

5. |

Build shareholder value. |

|

· |

We intend to launch a creative and effective IR / PR campaign to build the Galaxy Gaming brand in the financial community. |

|

· |

We will maintain frequent and informative communication with our stakeholders. |

|

● Equity is preferred over debt. |

|

| ● Use of Proceeds: |

|

Product Manufacturing & Installation |

$ | 175,000 |

|

Research & Development |

$ | 150,000 |

|

Sales & Distribution Network |

$ | 100,000 |

|

Jackpot Funding Program |

$ | 50,000 |

|

General Working Capital |

$ | 25,000 |

|

Total: |

$ | 500,000 |

|

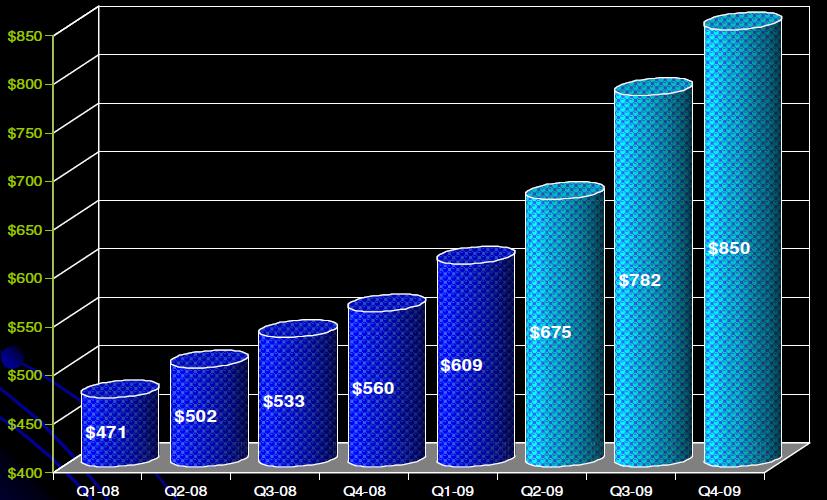

· We have a successful 11 year operating history.

· Except for equipment reimbursement, all of our income is high margin recurring revenue.

· The current economic pullback has had minimal negative affect on us.

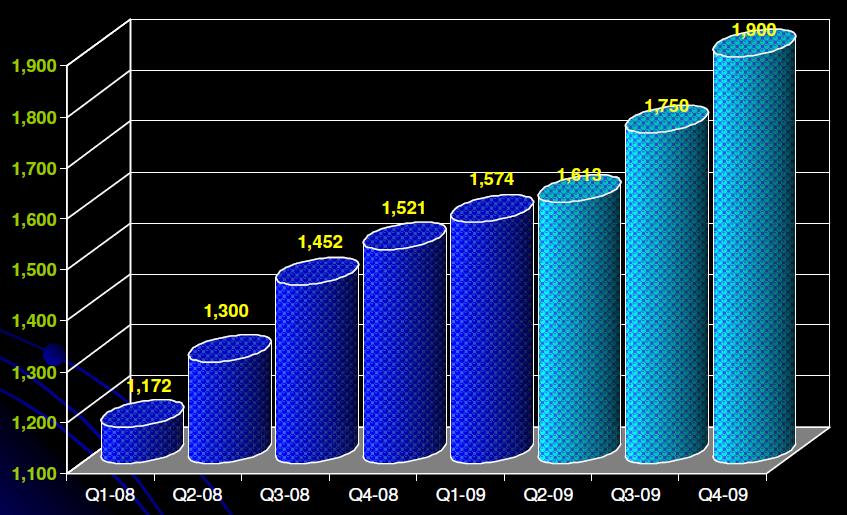

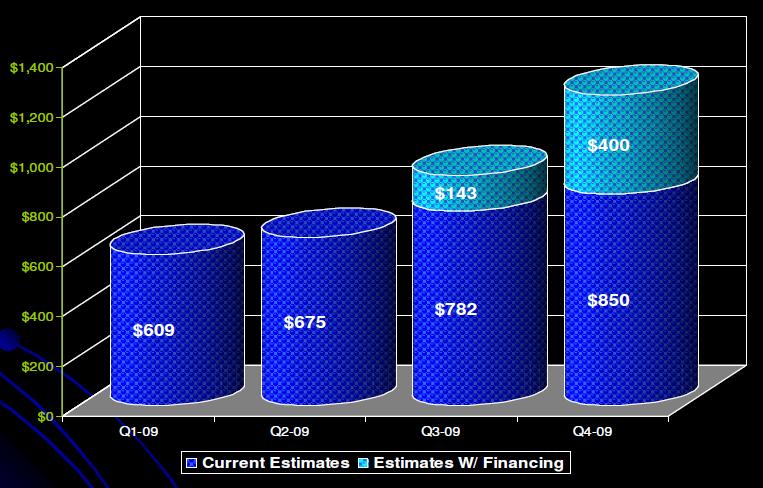

· We expect 2009 revenues to be a 67% increase over 2008.

· We expect to remain profitable.

· We are frugal. Any capital raised at this time will be devoted to support additional growth initiatives, not to fund losses or retire debt. |

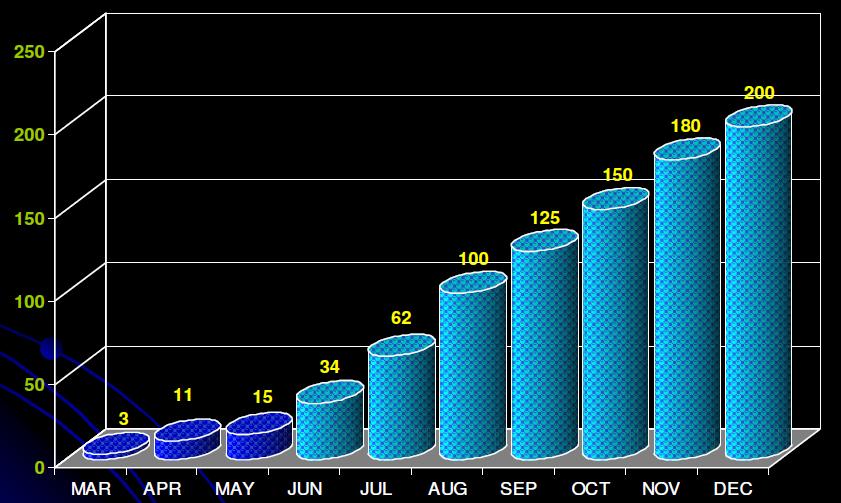

Tables in Service

|

|

Revenues

| |

|

Profits

|