Exhibit 10.2

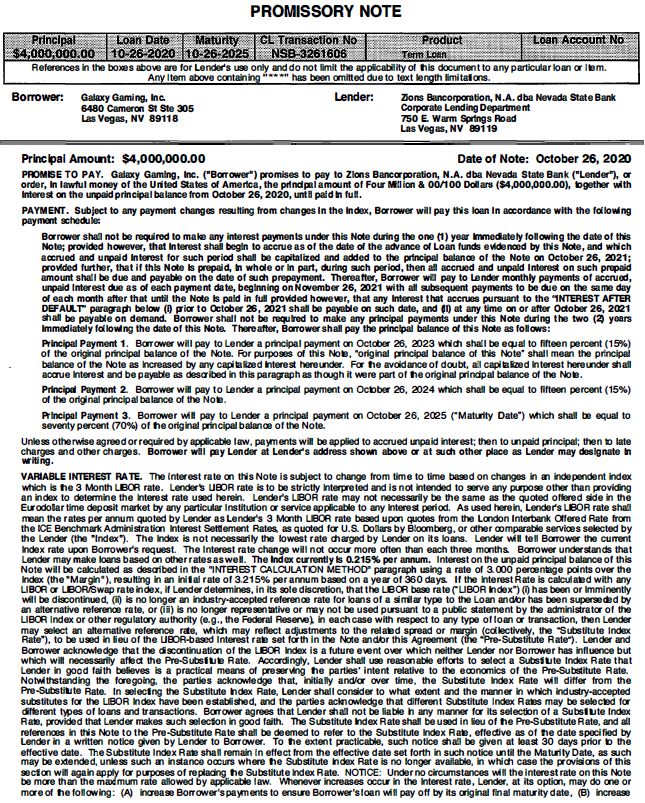

PROMISSORY NOTE References in the boxes above are for Lender's use only and do not limit the applicability of this document to any particular loan or Item. An Item above containing "***" has

been omitted due to text len th limitations. Borrower: Galaxy Gaming, Inc. 6480 Cameron St Ste 305 Las Vegas, NV 89118 Prlnclpal Amount: $4,000,000.00 Lender: Zions Bancorporation, N.A. dba Nevada State Bank

Corporate Lending Department 750 E. Warm Springs Road Las Vegas, NV 89119 Date of Note: October 26, 2020 PROMISE TO PAY. Galaxy Gaming, Inc. ("Borrower") promises to pay to Zions Bancorporation, N.A. dba Nevada State Bank ("Lender"),

or order, In lawful money of the U nited States of America, the prlnclpal amount of Four MUiien & 00/100 Dollars ($4,000,000.00), together with Interest on the unpaid principal balance from October 26, 2020, until paid In full. PAYMENT.

Subject to any payment changes resulting from changes In the Index, Borrower will pay this loan In accordance with the following payment schedule: Borrower shall not be required to make any interest payments under this Note during the one (1)

year Immediately following the date of this Note; provided however, that Interest shall begin to accrue as of the date of the advance of Loan funds evidenced by this Note, and which accrued and unpaid Interest for such period shall be

capitalized and added to the principal balance of the Note on October 26, 2021 ; provided further, that if this Note Is prepaid, In whole or In part, during such period, then all accrued and unpaid Interest on such prepaid amount shall be due

and payable on the date of such prepayment. Thereafter, Borrower will pay to Lender monthly payments of accrued, unpaid Interest due as of each payment date, beginning on November 26, 2021 with all subsequent payments to be due on the same day

of each month after that until the Note Is paid in full provided however, that any Interest that accrues pursuant to the "INTEREST AFTER DEFAULT'' paragraph below (i) prior to October 26, 2021 shall be payable on such date, and (II) at any time on or

after October 26, 2021 shall be payable on demand. Borrower shall not be required to make any principal payments under this Note during the two (2) years Immediately followlng the date of this Note. Thereafter, Borrower shall pay the principal

balance of this Note as follows: Principal Payment 1. Borrower will pay to Lender a principal payment on October 26, 2023 which shall be equal to fifteen percent (15%) of the original principal balance of the Note. For purposes of this Note,

"original principal balance of this Note" shall mean the principal balance of the Note as Increased by any capitalized Interest hereunder. For the avoidance of doubt, all capitalized Interest hereunder shall accrue Interest and be payable as

described in this paragraph as though it were part of the original principal balance of the Note. Principal Payment 2. Borrower will pay to Lender a principal payment on October 26, 2024 which shall be equal to fifteen percent (15%) of the

original principal balance of the Note. Principal Payment 3. Borrower will pay to Lender a principal payment on October 26, 2025 ("Maturity Oaten) which shall be equal to seventy percent (70%) of the original principal balance of the

Note. Unless otherwise agreed or required by applicable law, payments will be applied to accrued unpaid interest; then to unpaid principal; then to late charges and other charges. Borrower will pay Lender at Lender's address shown above or at

such other place as Lender may designate In writing. VARIABLE INTEREST RATE. The Interest rate on this Note is subject to change from time to time based on changes in an independent index which is the 3 Month LIBOR rate. Lender's LIBOR rate is

to be strictly Interpreted and is not intended to serve any purpose other than providing an index to determine the Interest rate used herein. Lender's LIBOR rate may not necessarily be the same as the quoted offered side in the Eurodollar time

deposit market by any particular Institution or service applicable to any Interest period. As used herein, Lender's LIBOR rate shall mean the rates per annum quoted by Lender as Lender's 3 Month LIBOR rate based upon quotes from the London

Interbank Offered Rate from the ICE Benchmark Administration Interest Settlement Rates, as quoted for U.S. Dollars by Bloomberg, or other comparable services selected by the Lender (the "Index"). The Index is not necessarily the lowest rate

charged by Lender on its loans. Lender will tell Borrower the current Index rate upon Borrower's request. The Interest rate change will not occur more often than each three months. Borrower understands that Lender may make loans based on other

rates as well. The Index currently Is 0.215% per annum. Interest on the unpaid principal balance of this Note will be calculated as described in the "INTEREST CALCULATION METHOD" paragraph using a rate of 3.000 percentage points over the Index

(the "Margin"), resulting in an initial rate of 3.215% per annum based on a year of 360 days. If the Interest Rate is calculated with any LIBOR or LIBOR/Swap rate index, if Lender determines, in its sole discretion, that the LIBOR base rate

("LIBOR Index") (i) has been or Imminently will be discontinued, (ii) is no longer an industry-accepted reference rate for loans of a similar type to the Loan and/or has been superseded by an alternative reference rate, or (iii) is no longer

representative or may not be used pursuant to a public statement by the administrator of the LIBOR Index or other regulatory authority (e.g., the Federal Reserve), in each case with respect to any type of loan or transaction, then Lender may

select an alternative reference rate, which may reflect adjustments to the related spread or margin (collectively, the "Substitute Index Rate"), to be used in lieu of the LIBOR-based Interest rate set forth in the Note and/or this Agreement

(the "Pre-Substitute Rate0). Lender and Borrower acknowledge that the discontinuation of the

LIBOR Index is a future event over which neither Lender nor Borrower has influence but which will necessarily affect the Pre-Substitute Rate. Accordingly, Lender shall use reasonable efforts to select a Substitute Index Rate that Lender in good

faith believes is a practical means of preserving the parties' intent relative to the economics of the Pre-Substitute Rate. Notwithstanding the foregoing, the parties acknowledge that, initially and/or over time, the Substitute Index Rate will

differ from the Pre-Substitute Rate. In selecting the Substitute Index Rate, Lender shall consider to what extent and the manner in which industry-accepted substitutes for the LIBOR Index have been established, and the parties acknowledge that

different Substitute Index Rates may be selected for different types of loans and transactions. Borrower agrees that Lender shall not be liable in any manner for its selection of a Substitute Index Rate, provided that Lender makes such

selection in good faith. The Substitute Index Rate shall be used in lieu of the Pre-Substitute Rate, and all references in this Note to the Pre-Substitute Rate shall be deemed to refer to the Substitute Index Rate, effective as of the date

specified by Lender in a written notice given by Lender to Borrower. To the extent practicable, such notice shall be given at least 30 days prior to the effective date. The Substitute Index Rate shall remain in effect from the effective date

set forth in such notice until the Maturity Date, as such may be extended, unless such an instance occurs where the Substitute Index Rate is no longer available, in which case the provisions of this section will again apply for purposes of

replacing the Substitute Index Rate. NOTICE: Under no circumstances will the interest rate on this Note be more than the maximum rate allowed by applicable law. Whenever increases occur in the Interest rate, Lender, at its option, may do one or

more of the following: (A) increase Borrower's payments to ensure Borrower's loan will pay off by its original final maturity date, (B) increase

CL Transaction No: NSB-3261606 PROMISSORY NOTE (Continued) Page 2 Borrower's payments to cover accruing interest, (C) increase the number of Borrower's payments, and (D) continue

Borrower's payments at the same amount and increase Borrower's final payment. INTEREST CALCULATION METHOD. Interest on this Note Is

computed on a 365/360 basis; that Is, by applying the ratio of the Interest rate over a year of 360 days, multiplied by the outstanding principal balance, multiplied by the actual number of days the principal balance is outstanding. All

Interest payable under this Note Is computed using this method. This calculation method results In a higher effective Interest rate than the numeric Interest rate stated In this Note. PREPAYMENT. Borrower agrees that all loan fees and other

prepaid finance charges are earned fully as of the date of the loan and will not be subject to refund upon early payment (whether voluntary or as a result of default), except as otherwise required by law. Except for the foregoing, Borrower

may pay without penalty all or a portion of the amount owed earlier than it is due. Early payments will not, unless agreed to by Lender in writing, relieve Borrower of Borrower's obligation to continue to make payments under the payment

schedule. Rather, early payments will reduce the principal balance due and may result in Borrower's making fewer payments. Borrower agrees not to send Lender payments marked "paid in full", "without recourse", or similar language. If

Borrower sends such a payment, Lender may accept it without losing any of Lender's rights under this Note, and Borrower will remain obligated to pay any further amount owed to Lender. All written communications concerning disputed amounts, including

any check or other payment instrument that indicates that the payment constitutes "payment In full" of the amount owed or that Is tendered with other conditions or limitations or as full satisfaction of a disputed amount must be mailed or

delivered to: Zions Bancorporation, N.A. dba Nevada State Bank, Enterprise Loan Operations, UT-RDWG-1970, PO Box 27181 Salt Lake City, UT 84127-0181. MAIN STREET LOAN PREPAYMENT. Notwithstanding anything to the contrary in the

PREPAYMENT paragraph or in this Note, any amount(s) prepaid by Borrower shall be applied to the succeeding principal payment(s) due under this Note. INTEREST AFTER DEFAULT. Upon default, including failure to pay upon final maturity, the interest rate on this Note shall be increased by adding an additional 3.000 percentage point margin ("Default Rate Margin"). The

Default Rate Margin shall also apply to each succeeding interest rate change that would have applied had there been no default. However, in no event will the interest rate exceed the maximum interest rate limitations under applicable law. DEFAULT. Each of the following shall constitute an event of default ("Event of Default") under this Note: Payment Default. Borrower fails to make any payment when due under this Note. Other Defaults. Borrower fails to comply with or to perform any other term, obligation, covenant or condition contained in this Note or in any of the related documents or to comply with or to perform any term,

obligation, covenant or condition contained in any other agreement between Lender and Borrower. Default In Favor of Third Parties.

Borrower or any Granter defaults under any loan, extension of credit, security agreement, purchase or sales agreement, or any other agreement, in favor of any other creditor or person that may materially affect any of Borrower's property or

Borrower's ability to repay this Note or perform Borrower's obligations under this Note or any of the related documents. False Statements. Any warranty, representation or statement made or furnished to Lender by Borrower or on Borrower's

behalf under this Note or the related documents is false or misleading in any material respect, either now or at the time made or furnished or becomes false or misleading at any time thereafter. Insolvency. The dissolution or

termination of Borrower's existence as a going business, the insolvency of Borrower, the appointment of a receiver for any part of Borrower's property, any assignment for the benefit of creditors, any type of creditor workout, or the

commencement of any proceeding under any bankruptcy or insolvency laws by or against Borrower. Creditor or Forfeiture Proceedings.

Commencement of foreclosure or forfeiture proceedings, whether by judicial proceeding, self-help, repossession or any other method, by any creditor of Borrower or by any governmental agency against any collateral securing the loan. This

includes a garnishment of any of Borrower's accounts, including deposit accounts, with Lender. However, this Event of Default shall not apply if there is a good faith dispute by Borrower as to the validity or reasonableness of the claim

which is the basis of the creditor or forfeiture proceeding and if Borrower gives Lender written notice of the creditor or forfeiture proceeding and deposits with Lender monies or a surety bond for the creditor or forfeiture proceeding, in

an amount determined by Lender, in its sole discretion, as being an adequate reserve or bond for the dispute. Events Affecting

Guarantor. Any of the preceding events occurs with respect to any guarantor, endorser, surety, or accommodation party of any of the indebtedness or any guarantor, endorser, surety, or accommodation party dies or becomes incompetent, or

revokes or disputes the validity of, or liability under, any guaranty of the indebtedness evidenced by this Note. Change In Ownership. Any change in ownership of twenty-five percent (25%) or more of the common stock of Borrower. Adverse Change. A material

adverse change occurs in Borrower's financial condition, or Lender believes the prospect of payment or performance of this Note is impaired. Cure Provisions. If any default, other than a default in payment, is curable and if Borrower has not been given a notice of a breach of the same provision of this Note within the preceding twelve (12) months, it may be cured if

Borrower, after Lender sends written notice to Borrower demanding cure of such default: (1) cures the default within ten (10) days; or (2) if the cure requires more than ten (10) days, immediately initiates steps which Lender deems in

Lender's sole discretion to be sufficient to cure the default and thereafter continues and completes all reasonable and necessary steps sufficient to produce compliance as soon as reasonably practical. LENDER'S RIGHTS. Upon default, Lender may declare the entire unpaid principal balance under this Note and all accrued unpaid interest immediately due, and then Borrower

will pay that amount. ATTORNEYS' FEES; EXPENSES. Lender may hire or pay someone else to help collect this Note if Borrower does not pay. Borrower will pay Lender that amount. This includes, subject to any limits under

applicable law, Lender's attorneys' fees and Lender's legal expenses, whether or not there is a lawsuit. including attorneys' fees, expenses for bankruptcy proceedings (including efforts to modify or vacate any automatic stay or

injunction), and appeals. If not prohibited by applicable law, Borrower also will pay any court costs, in addition to all other sums provided by law. GOVERNING LAW. This Note will be governed by federal law applicable to Lender and, to the extent not preempted by federal law, the laws of the State of Nevada without regard to its conflicts of law provisions. This Note

has been accepted by Lender In the State of Nevada. CHOICE OF VENUE. If there ijl laporrower agrees upon Lender's request to submit to the jurisdiction of the courts

of Clark County, State of Nevada. (Initial Here) DISHONORED ITEM FEE. Borrower will pay a fee to Lender of $20.00 if Borrower makes a payment on Borrower's loan and the check or preauthorized charge with which Borrower pays is later dishonored.

CL Transaction No: NSB-3261606 PROMISSORY NOTE (Continued) Page 3 RIGHT OF SETOFF. To the extent permitted by applicable law, Lender reserves a right of

setoff in all Borrower's accounts with Lender (whether checking, savings, or some other account). This includes all accounts Borrower holds jointly with someone else and all accounts Borrower may open in the future. However, this does

not include any IRA or Keogh accounts, any trust accounts for which setoff would be prohibited by law, or monies benefits, siunp apnleym aecnctoaul nstes ctuhraitty w iencreo mreec ebiveende fpitusr saunadn td tios atbhieli tfye

dinesraulr aSnocceia lb Seenecufirtisty. ABcot,r rionwcleurd ianugt,h woritizheosu tL leimnditeart,i otno, rtehteir eemxteenntt apnedr msuitrtveivdo rbsy' applicable law, to charge or setoff all sums owing on the indebtedness against

any and all such accounts, and, at Lender's option, to administratively freeze all such accounts to allow Lender to protect Lender's charge and setoff rights provided in this paragraph. EXCLUSION OF TAXES AND INSURANCE. Please note that the above-referenced payment amount does not include any amount attributable to the payment of taxes or insurance. Any and all payments for taxes and insurance shall remain your separate obligation to be paid

directly by you to the proper parties, and such payment amounts have not been calculated into the above-referenced payment amount. REPORTING NEGATIVE INFORMATION. We {Lender) may report information about your

{Borrower's) accouwred Late payments, missed payments, or other defaults on your account may be reflected in your credit report. (Initial Here -,,---=..--\) . DISPUTE RESOLUTION PROVISION. This Dispute Resolution Provision contains a jury waiver, a

class action waiver, and an arbitration clause {or judicial reference agreement, as applicable), set out In four Sections. READ IT CAREFULLY. SECTION 1. GENERAL PROVISIONS GOVERNING ALL DISPUTES. 1.1 PRIOR DISPUTE

RESOLUTION AGREEMENTS SUPERSEDED. This Dispute Resolution Provision shall supersede and replace any prior "Jury Waiver," "Judicial Reference," "Class Action Waiver," "Arbitration," "Dispute Resolution," or similar alternative dispute

agreement or provision between or among the parties. r1e.l2a ted "DISPUTE" defined. As used herein, the word

"Dispute" includes, without limitation, any claim by either party against the other party to this Agreement, any Related Document, and the Loan evidenced hereby. In addition, "Dispute" also Includes any claim by either party against the

other party regarding any other agreement or business rela)ionship between any of them whether or not related to the Loan or other subject matter of this Agreement. "Dispute" includes, but is not limited to, matters arising from or

relating to a deposit account, an application foobrl iogar tdioennsia la o pf acrrteyd hite, rwetaor ramnatyie sh aavned troe parensoethnetar tipoanrst ym, acdoem bpylia an cpea rtwyi,t hth aep apdliecqaubalec yla owf sa apnadr/tyo'rs

rdeigsucllaotsiourness, , peenrffoorrcmeamnecnet oorf saenryv iacneds aplrlo ovfi dtehde under any agreement by a party, including without limitation disputes based on or arising from any alleged tort or matters involving the employees,

officers, agents, affiliates, or assigns of a party hereto. If a third party is a party to a Dispute {such

as a credit reporting agency, merchant accepting a credit card, junior lienholder or title company), ethaacth p paartryty. hereto agrees to consent to including that third party in any arbitration or judicial reference proceeding for

resolving the Dispute with 1.3 Jury Trial Waiver. Each party waives their respective rights to a trial

before a jury In connectjon with any Dispute. and all .P.i.Sl2wes. shall be resolyed by a judge silling without a jury. If a court determines that this jury trial waiver is not enforceable for any reason, then at any time prior to trial

of the Dispute, but not later than 30 days after entry of the order determining this provision is unenforceable, any party shall be entitled to move the court for an order, as applicable: {A) compelling arbitration and staying or

dismissing such litigation pending arbitration (" Arbitration Order'') under Section 2 hereof, or (B) staying such litigation and compelling judicial reference under Section 3 hereof. 1.4 CLASS ACTION WAIVER. If permitted by applicable law, each party waives the right to litigate In court or an arbitra)ion proceeding any Dispute as a cJass action. either as a member of a class or as a representative. or to act as a private attorney

general, 1.5 SURVIVAL. This Dispute Resolution Provision shall survive any termination, amendment or

expiration of this Agreement, or any other relationship between the parties. SECTION 2. Arbitration IF JURY WAIVER UNENFORCEABLE (EXCEPT CALIFORNIA). If (but only if) a state or federal court located outside the

sDtiastpeu toef, Cthaelifno ranniay dpeatretrym hineerse tfoo rm aanyy rreeqausioren tthhaatt tshaeid j uDryis ptruiatel wbaei vreers oinlv tehdis bDy isbpinudtein gR easrobluittriaotnio Pn ropvuirssiuoan nits tnoo tt heinsf

oSrceecatibolne 2w ibthe foreresp aec st intog lae arbitrator. An arbitrator shall have no authority to determine matters (i) regarding the validity, enforceability, meaning, or scope of this Dispute Resolution Provision, or (ii) class

action claims brought by either party as a class representative on behalf of others and claims by a class representative on either party's behalf as a class member, which matters may be determined only by a court without a jury. By

agreeing to arbitrate a Dispute. each party gives up any right that party may have to a jury trial. as well as other rights that party would have In court that are not available or are more liroited In arbitration such as the rights to

discovery and to appeal Arbitration shall be commenced by filing a petition with, and in accordance with the

applicable arbitration rules of, National Arbitration Forum ("NAF") or Judicial Arbitration and Mediation Service, Inc. ("JAMS") ("Administrator") as selected by the initiating party. However, if the parties agree, arbitration may be

commenced by appointment of a licensed attorney who is selected by the parties and who agrees to conduct the arbitration without an Administrator. If NAF and JAMS both decline to administer arbitration of the Dispute, and if the parties

are unable to mutually agree upon a licensed attorney to act as arbitrator with an Administrator, then either party may file a lawsuit (in a court of appropriate venue outside the state of California) and move for an Arbitration Order.

The arbitrator, howsoever appointed, shall have expertise in the subject matter of the Dispute. Venue for the arbitration proceeding shall be at a location determined by mutual agreement of the parties or, if no agreement, in the city

and state where Lender or Bank is headquartered. The arbitrator shall apply the law of the state specified in the agreement giving rise to the Dispute. After entry of an Arbitration Order, the non-moving party shall commence arbitration. The moving party shall, at its discretion, also be entitled to commence arbitration but is under no

obligation to do so, and the moving party shall not in any way be adversely prejudiced by electing not to commence arbitration. The arbitrator: (i) will hear and rule on appropriate dispositive motions for judgment on the pleadings, for

failure to state a claim, or for full or partial summary judgment; (ii) will render a decision and any award applying applicable law; (iii) will give effect to any limitations period in determining any Dispute or defense; (iv) shall

enforce the doctrines of compulsory counterclaim, res judicata, and collateral aepstpolyp pel, if applicable; {v) with regard to motions and the arbitration hearing, shall apply rules of evidence governing civil cases; and (vi) will the

law of the state specified in the agreement giving rise to the Dispute. Filing of a petition for arbitration shall not prevent any party finrocmlud {ini)g sebuetk inngo t alnimdi teodb tatoin iningju nfrcotmive ar ecloieufr, t porof

pceormtyp perteesnet rvjuartisiodnic otiordne r(sn, oftowreithclsotsaunrdei,n ge voicntgioonin, ga tatarbchitrmateionnt,) rperpolevvisiino, ngaal ronri sahnmceilnlatr, ya nredm/oerd tihees appointment of a receiver, (ii) pursuing

non-judicial foreclosure, or (iii) availing itself of any self-help remedies such as setoff and repossession. The exercise of such rights shall not constitute a waiver of the right to submit any Dispute to arbitration. Jaundyg ment upon an arbitration award may be entered in any court having jurisdiction except that, if the arbitration

award exceeds $4,000,000, party shall be entitled to a de novo appeal of the award before a panel of three arbitrators. To allow for such appeal, if the award (including Administrator, arbitrator, and attorney's fees and costs) exceeds

$4,000,000, the arbitrator will issue a written, reasoned decision supporting the award, including a statement of authority and its application to the Dispute. A request for de novo appeal must be filed with the arbitrator within 30

days following the date of the arbitration award; if such a request is not made within that time period, the arbitration decision shall

CL Transaction No: NSB-3261 606 PROMISSORY NOTE (Continued) Page 4 become final and binding. On appeal, the arbitrators shall review the award

de novo, meaning that they shall reach their own findings of fact and conclusions of law rather than deferring in any manner to the original arbitrator. Appeal of an arbitration award shall be pursuant to the rules of the

Administrator or, if the Administrator has no such rules, then the JAMS arbitration appellate rules shall apply. Arbitration under this provision concerns a transaction involving interstate commerce and shall be governed by the

Federal Arbitration Act, 9 U.S.C. § 1 et seq. If the terms of this Section 2 vary from the Administrator's rules, this Section 2 shall control. SECTION 3. JUDICIAL REFERENCE IF J U RY WAIVER UNENFORCEABLE (CALIFORNIA ONLY). If (but

only if) a Dispute is filed in a state or federal court located within the state of California, and said court determines for any reason that the jury trial waiver in this Dispute Resolution Provision is not enforceable with respect

to that Dispute, then any party hereto may require that Dispute be resolved by judicial reference in accordance with California Code of Civil Procedure, Sections 638, . including without limitation whether the Dispute is subject to a judicial reference proceeding. By agreeing to resolve Plspytes by Judicial reference each party 1s

giving up any right that party may have to a jury trial The referee shall be a retired judge, agreed upon by the parties, from either the American Arbitration Association (AAA) or Judicial Arbitration and Mediation Service, Inc.

(JAMS). If the parties cannot agree on the referee, the party who initially selected the reference procedure shall request a panel of ten retired judges from either AAA or JAMS, and the court shall select the referee from that

panel. (If AAA and JAMS are unavailable to provide this service, the court may select a referee by such other procedures as are used by that court.) The referee shall be appointed to sit with all of the powers provided by law,

including the power to hear and determine any or all of the issues in the proceeding, whether of fact or of law, and to report a statement of decision. The parties agree that time is of the essence in conducting the judicial

reference proceeding set forth herein. The costs of the judicial reference proceeding, including the fee for the court reporter, shall be borne equally by the parties as the costs are incurred, unless otherwise awarded by the

referee. The referee shall hear all pre-trial and post-trial matters (including without limitation requests for equitable relief), prepare a statement of decision with written findings of fact and conclusions of law, and apportion

costs as appropriate. The referee shall be empowered to enter equitable relief as well as legal relief, provide all temporary or provisional remedies, enter equitable orders that are binding on the parties and rule on any motion

that would be authorized in a trial, including without limitation motions for summary adjudication. Only for this Section 3, "Dispute" includes matters regarding the validity, enforceability, meaning, or scope of this Section, and

(ii) dass action dajms brought by ejther party as a ciass representative on behalf of others and claims by a dass representatjve on ejther party's behalf as a ciass member. Judgment upon the award shall be entered in the court in

which such proceeding was commenced and all parties shall have full rights of appeal. This provision will not be deemed to limit or constrain Bank or Lender's right of offset, to obtain provisional or ancillary remedies, to

lnterplead funds in the event of a dispute, to exercise any security Interest or lien Bank or Lender may hold in property or to comply with legal process involving accounts or other property held by Bank or Lender. Nothing herein

shall preclude a party from moving (prior to the court ordering judicial reference) to dismiss, stay or transfer the suit to a forum outside California on grounds that California is an improper, inconvenient or less suitable venue.

If such motion is granted, this Section 3 shall not apply to any proceedings in the new forum. This Section 3 may be invoked only with regard to Disputes filed in state or federal courts located in the State of California. In no

event shall the provisions in this Section 3 diminish the force or effect of any venue selection or jurisdiction provision in this Agreement or any Related Document. SECTION 4. Reliance. Each party (i) certifies that no one has

represented to such party that the other party would not seek to enforce a jury waiver, class action waiver, arbitration provision or judicial reference provision in the event of suit, and (ii) acknowledges that it and the other

party have been induced to enter into this Agreement by, among other things, material reliance upon the mutual waivers, agreements, and certifications in the four Sections of this DISPUTE RESOLUTION PROVISION. ON-LINE BANKING - LOAN

PAYMENTS. From time to time, Lender may (but shall not be required to) permit loan payments to be made through its online banking website. Lender may impose and change limitations on making online loan payments, such as minimum or

maximum payment amounts, the types of accounts from which loan payments may be made, and the types of payments that may be made onllne (I.e. , ordinary Installment payments, principal-only payments, or other types of payments).

Whether online payments are permitted, and Lender's applicable terms and restrictions If such payments are permitted, will be reflected in the features available online when a user logs into the online banking website. WAIVER OF

DEFENSES AND RELEASE OF CLAIMS. The undersigned hereby (i) represents that neither the undersigned nor any affiliate or principal of the undersigned has any defenses to or setoffs against any Indebtedness or other

obligations owing by the undersigned, or by the undersigned's affiliates or principals, to Lender or Lender's affiliates (the "Obligations"), nor any claims against Lender or Lender's afflllates for any matter whatsoever, related or

unrelated to the Obligations, and (II) releases Lender and Lender's affiliates, officers, directors, employees and agents from all claims, causes of action, and costs, In law or equity, known or unknown, whether or not matured or

contingent, existing as of the date hereof that the undersigned has or may have by reason of any matter of any conceivable kind or character whatsoever, related or unrelated to the Obligations, including the subject matter of this

Agreement. The foregoing release does not apply, however, to claims for future performance of express contractual obligations that mature after the date hereof that are owing to the undersigned by Lender or Lender's affiliates. As

used in this paragraph, the word "undersigned" does not include Lender or any individual signing on behalf of Lender. The undersigned acknowledges that Lender has been induced to enter into or continue the Obligations by, among

other things, the waivers and releases in this paragraph. DOCUMENT IMAGING. Lender shall be entitled, in its sole discretion, to image or make copies of all or any selection of the agreements, Instruments, documents, and Items and

records governing, arising from or relating to any of Borrower's loans, including, without limitation, this document and the Related Documents, and Lender may destroy or archive the paper originals. The parties hereto (i) waive any

right to Insist or require that Lender produce paper originals, (Ii) agree that such images shall be accorded the same force and effect as the paper originals, (iii) agree that Lender is entitled to use such images in lieu of

destroyed or archived originals for any purpose, including as admissible evidence in any demand, presentment or other proceedings, and (iv) further agree that any executed facsimile (faxed), scanned, or other imaged copy of this

document or any Related Document shall be deemed to be of the same force and effect as the original manually executed document. SUCCESSOR INTERESTS. The terms of this Note shall be binding upon Borrower, and upon Borrower's heirs,

personal representatives, successors and assigns, and shall inure to the benefit of Lender and its successors and assigns. MANDATORY PREPAYMENT. If, on any date (such date, a "Trigger Date"), the Board of Governors of the Federal

Reserve System or a designee thereof has, after consultation with Lender, notified Lender in writing that the Borrower has materially breached, made a material misrepresentation with respect to or otherwise failed to comply with

certifications in Section 2 (CARES Act Borrower Eligibility Certifications and Covenants) or Section 3 (FAA and Regulation A Borrower Eligibility Certifications) of the Borrower Certifications and Covenants executed by Borrower in

connection with the Loan in any material respect or that any such certification has failed to be true and correct in any material respect, then Lender shall promptly so notify the Borrower and the Borrower shall, no later than two

(2) business days after such Trigger Date, prepay the Note in full, along with any accrued and unpaid interest thereon. GENERAL PROVISIONS. If any part of this Note cannot be enforced, this fact will not affect the rest of the Note.

Lender may delay or forgo enforcing any of its rights or remedies under this Note without losing them. Borrower and any other person who signs, guarantees or endorses this Note, to the extent allowed by law, waive presentment,

demand for payment, and notice of dishonor. Upon any change in the terms of this

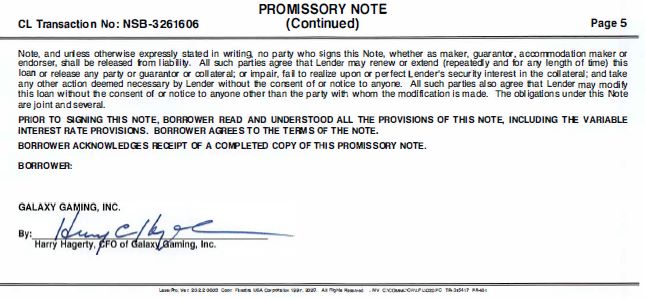

CL Transaction No: NSB-3261606 PROMISSORY NOTE (Continued) Page 5 Note, and endorser, suhnallel sbse

ortehleerawseisde feroxmpr elisasblyil itsyt.a teAdll insu wchr itpinagrt, ienso apgarertey twhahto Lseignndse rt hmisa yN oretene, ww hoert heexrte ansd m(raekpeera, tegdulayr aanntdo rf,o ar cacnoym lmenogdtaht ioofn tmimaek)e

trh oisr loan or release any party or guarantor or collateral; or impair, fail to realize upon or perfect Lender's security interest in the collateral; and take tahnisy lootahne rw aicthtioount dtheeem ceodn sneencte osfs aorry

n boyti cLee ntode ar nwyoitnheo uott htheer tchoanns tehnet opaf rotry nwoittihc ew thoo man ythoene m. oAdilfli csautcioh np iasr tmieasd ael.s oT ahger eoeb litghaatti oLnesn duenrd emra tyh ims oNdoitfey are joint and

several. PRIOR TO SIGNING THIS NOTE, BORROWER READ AND UNDERSTOOD ALL THE PROVISIONS OF THIS NOTE,

INCLUDING THE VARIABLE INTEREST RATE PROVISIONS. BORROWER AGREES TO THE TERMS OF THE NOTE. BORROWER

ACKNOWLEDGES RECEIPT OF A COMPLETED COPY OF THIS PROMISSORY NOTE. BORROWER: lasefPro, Ver. 20. 2.20003 cocr. Anastra USA COrporallon 1 997. 2020. Al R,gtlls RHlfVed • NV C;'CO'-"ML'CFN.PL. FC TR-31541 7 PR-401