UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For the fiscal year ended

For the transition period from to

Commission file number:

(Exact name of small business issuer as specified in its charter)

|

||

(State or other jurisdiction of incorporation or organization) |

|

(IRS Employer Identification No.) |

|

||

(Address of principal executive offices)

|

||

( |

||

(Registrant’s telephone number) |

||

Securities registered under Section 12(b) of the Act: None

Title of each class |

|

Trading symbol |

|

Name of exchange on which registered |

|

|

OTCQB marketplace |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by checkmark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the issuer has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ Accelerated filer ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standard provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s second fiscal quarter $

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date:

GALAXY GAMING, INC.

ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2024

TABLE OF CONTENTS

|

|

|

|

|

PART I |

||||

Item 1. |

|

|

|

4 |

Item 1A. |

|

|

8 |

|

Item 1B. |

|

|

10 |

|

Item 1C. |

|

|

10 |

|

Item 2. |

|

|

11 |

|

Item 3. |

|

|

11 |

|

Item 4. |

|

|

11 |

|

PART II |

||||

Item 5. |

|

Market for Registrant’s Common Equity and Related Stockholder Matters |

|

12 |

Item 7. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

14 |

Item 7A. |

|

|

18 |

|

Item 8. |

|

Financial Statements and Supplementary Financial Information |

|

19 |

Item 9. |

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

40 |

Item 9A. |

|

|

40 |

|

Item 9B. |

|

|

40 |

|

Item 9C. |

|

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

|

40 |

PART III |

||||

Item 10. |

|

|

|

41 |

Item 11. |

|

|

44 |

|

Item 12. |

|

Security Ownership of Certain Beneficial Owners and Management, and Related Stockholder Matters |

|

50 |

Item 13. |

|

Certain Relationships and Related Transactions, and Director Independence |

|

51 |

Item 14. |

|

|

51 |

|

PART IV |

||||

Item 15. |

|

|

|

53 |

2

In this filing, we refer to: (i) our audited consolidated financial statements and notes thereto as our “Financial Statements,” (ii) our audited Consolidated Statements of Operations and Comprehensive Loss as our “Statements of Operations,” (iii) our audited Consolidated Balance Sheets as our “Balance Sheets,” (iv) our audited Consolidated Statements of Cash Flows as our “Statements of Cash Flows,” and (v) Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations as our “Results of Operations.”

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (“Annual Report”) contains “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Private Securities Litigation Reform Act of 1995, as do other materials or oral statements we release to the public. Forward-looking statements are neither historical facts nor assurances of future performance, but instead are based only on our current beliefs, expectations, and assumptions regarding the future of our business, plans and strategies, projections, anticipated events and trends, the economy, and other future conditions, as of the date on which this report is filed. Forward-looking statements often, but do not always, contain words such as “may,” “will,” “should,” “could,” “might,” “expect,” “intend,” "target," “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” or the negative of these terms or other similar expressions. These forward-looking statements are only predictions. We have based these forward-looking statements on our current expectations, assumptions and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. These forward-looking statements speak only as of the date of this Annual Report and are subject to a number of risks and uncertainties. These risks and uncertainties include, but are not limited to, the ability to complete the Merger (as defined herein) on the proposed terms or on the anticipated timeline, or at all, including risks and uncertainties related to securing the necessary stockholder approval, gaming regulatory approvals and satisfaction of other closing conditions to consummate the proposed Merger; the occurrence of any event, change or other circumstance that could give rise to the termination of the Merger Agreement (as defined herein); risks that the proposed Merger disrupts the Company’s (as defined herein) current plans and operations or diverts the attention of the Company’s management or employees from ongoing business operations; the risk that certain restrictions during the pendency of the Merger may impact the Company's ability to pursue certain business opportunities or strategic transactions; the risk of potential difficulties with the Company’s ability to retain and hire key personnel and maintain relationships with customers and other third parties as a result of the proposed Merger, including during the pendency of the Merger; the risk that the proposed Merger may involve unexpected costs and/or unknown or inestimable liabilities; the risk that the Company’s business may suffer as a result of uncertainty surrounding the proposed Merger; the risk that stockholder litigation in connection with the proposed Merger may affect the timing or occurrence of the proposed Merger or result in significant costs of defense, indemnification and liability; effects relating to the announcement of the proposed Merger or any further announcements or the consummation of the proposed Merger on the market price of the Company’s common stock or the Company’s operating results; the ability of Galaxy Gaming to enter and maintain strategic alliances, product placements or installations in land based casinos or grow its iGaming business, garner new market share, secure licenses in new jurisdictions or maintain existing licenses, successfully develop or acquire and sell proprietary products, comply with regulations, including changes in gaming related and non-gaming related statutes and regulations that affect the revenues of our customers in land-based casino and, online casino markets, have its games approved by relevant jurisdictions, unfavorable economic conditions in the US and worldwide, our level of indebtedness, restrictions and covenants in our loan agreement, dependence on major customers, protection of intellectual property and our ability to license the intellectual property rights of third parties, failure to maintain the integrity of our information technology systems, including without limitation, cyber-attacks or other failures in our telecommunications or information technology systems, or those of our collaborators, third-party logistics providers, distributors or other contractors or consultants, could result in information theft, data corruption and significant disruption of our business, and other factors. The events and circumstances reflected in our forward-looking statements may not be achieved or occur, and actual results could differ materially from those projected in the forward-looking statements. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise.

3

PART I

ITEM 1. BUSINESS

BUSINESS

Unless the context indicates otherwise, references to “Galaxy Gaming, Inc.,” “we,” “us,” “our,” or the “Company,” refer to Galaxy Gaming, Inc., a Nevada corporation (“Galaxy Gaming”).

We are an established global gaming company specializing in the design, development, acquisition, assembly, marketing and licensing of proprietary casino table games, side bets, and associated technology, platforms and systems for the casino and iGaming industries. Casinos use our proprietary products and services to enhance their gaming operations and improve their profitability and productivity, as well as to offer popular cutting-edge gaming entertainment content and technology to their players. We market our products and services to online and land-based casinos worldwide with products currently present in North America, the Caribbean, Central America, the United Kingdom, Europe, Africa, and to cruise ships exploring the world's oceans. We license our products and services for use in regulated land-based gaming markets. We also license our content and distribute content from other companies to iGaming operators in gaming markets throughout the world where iGaming is not illegal.

On July 18, 2024, we entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Evolution Malta Holding Limited, a company registered in Malta (“Parent”), and Galaga Merger Sub, Inc., a Nevada corporation and direct wholly owned subsidiary of Parent (“Merger Sub”), pursuant to which, and subject to the terms and conditions thereof, Merger Sub would merge with and into the Company (the “Merger”), with the Company surviving the Merger as a wholly owned subsidiary of Parent.

Upon the closing of the Merger, each share of common stock, par value $0.001 per share of the Company issued and outstanding immediately prior to the effective time of the Merger, other than any Company common stock (i) owned by Company stockholders who are entitled to demand and have properly and validly demanded their appraisal rights under Nevada law or (ii) owned by Parent, Merger Sub, the Company or by any of their respective subsidiaries, will be converted automatically into the right to receive $3.20 per share in cash, without interest and subject to any applicable withholding taxes.

Consummation of the Merger is subject to the satisfaction or waiver of certain closing conditions, including approval by at least a majority of the voting power of the outstanding shares of the Company’s common stock of the Merger Agreement and the transactions contemplated thereby, including the Merger, and the receipt of certain gaming regulatory approvals. At the special meeting of the Company’s stockholders held on November 12, 2024, stockholders voted to approve the Merger. The Merger is expected to be completed in mid-2025, subject to satisfaction or waiver of the closing conditions. Upon completion of the Merger, the Company will become a privately held company and shares of Company’s common stock will no longer be listed on any public market.

Products and Services

We have two revenue streams which operate as a single reporting segment. In our GG Core revenue stream, we license our products to regulated terrestrial gaming establishments in the physical world (casinos, racinos, cruise ships, etc.) and to providers of gaming devices such as electronic table games (“ETG’s"). In our GG Digital revenue stream, we license our products to gaming establishments in the virtual world (online casinos and other gaming-related websites) where online gaming is not illegal.

Proprietary Table Games. Casinos use Proprietary Table Games together with or in lieu of other games in the public domain (e.g. Blackjack, Craps, Roulette, etc.) because of their popularity with players and to increase profitability. Typically, Proprietary Table Games are grouped into two product types referred to as “Side Bets” and “Premium Games.” Side Bets are proprietary features and wagering options typically added to public domain games such as baccarat, pai gow poker, craps and blackjack table games. Examples of our Side Bets include 21+3®, Lucky Ladies®, and Bonus Craps™. Premium Games are unique stand-alone games with their own set of rules and strategies. Examples of our Premium Games include Heads Up Hold ’em®, High Card Flush®, Cajun Stud®, Three Card Poker®, and EZ Baccarat. Generally, Premium Games generate higher revenue per table placement for us than do the Side Bet games.

Enhanced Table Systems. Enhanced Table Systems are electronic enhancements used on casino table games to add to player appeal and to enhance game security. An example in this category is our new Galaxy Operating System (“GOS”), an advanced electronic system installed on gaming tables designed to collect data by detecting player wagers and other game activities. This information is processed and used to improve casino operations by evaluating game play, to improve dealer efficiency and to reward players through the offering of jackpots and other bonusing mechanisms. Typically, the GOS system includes an electronic video display, marketed by Galaxy as the Lunar Table Display ("LTD"), which shows game information designed to generate player interest and to promote various aspects of the game. The GOS system can also be used to network numerous gaming tables together into a common system either within a casino or through the interconnection of multiple casinos. Our new systems utilize off-the-shelf computer hardware and are developed

4

using widely supported programming languages so as to be easily reviewable by the gaming laboratories that certify these types of products for use in casinos. Additionally, GOS also allows us to add new functionality as periodic releases without the need to replace the fundamental hardware or software supporting the platform.

Product Strategy. In the physical casino market, we have a “three-dimensional” growth strategy. First, we seek to increase the number of casinos we serve with our Proprietary Table Games and Enhanced Table Systems. Second, within a casino, we seek to increase the number of tables on which we have placements. Finally, by adding our enhanced systems to tables that already have our content, we can increase the billable units per table. For example, on a blackjack table that has one of our side bets, we can add a second side bet and a progressive jackpot for each side bet, thereby increasing the billable units for that table from one to four. Our current product placements are heavily concentrated around blackjack, and we have developed or licensed side bets and other game content to address other table game categories such as baccarat, roulette and craps.

iGaming Strategy. Our iGaming strategy is centered on maximizing content distribution across a wide array of online platforms. The iGaming content mirrors the offerings of land-based games and our customer in this channel base spans both business to consumer ("B2C") and business to business ("B2B") models. This dual approach enables us to forge direct partnerships with random number generator ("RNG") operators while also leveraging our global presence through B2B Live Dealer collaborations. In the digital gaming world, a "skin" refers to a uniquely branded and marketed casino URL. Operators often manage multiple skins to cater to diverse markets and themes. Our strategy focuses on expanding our content reach across as many skins as possible and maximizing the number of our games featured on each skin. Looking forward, we anticipate further legalization of online gaming across additional U.S. states, creating opportunities for our partners to engage a broader audience, however such expansion of iGaming is dependent on state and local legislators and regulators.

Recurring Revenue and Gross Profit

A majority of our clients contract with us to use our products and services on a month-to-month or annual basis with typically a 30–45 day termination notice requirement. We invoice our clients monthly, either in advance for unlimited use or in arrears for actual use, depending on the product or contract terms. Such recurring revenues accounted for substantially all of our total revenues in 2024. In 2023, we entered into perpetual license arrangements with a large customer where the customer paid an amount up front for hardware required to operate our products and to have a perpetual right to use our gaming systems. In 2024 and 2023, these perpetual license transactions accounted for 11% and 13%, respectively, of our total net revenues.

In general, our license revenues have few direct costs thereby generating high gross profit margins. We do not report “gross profit” in our statements of operations included in this report. Instead, gross profit would be comparable to “revenues” minus “cost of ancillary products and assembled components,” both of which are presented in our statements of operations. For the game content that we license from third parties, we pay royalties to game owners whose content we re-license to casino operators. Depending on the relationship between Galaxy and the licensor, those royalties are either deducted from gross revenue to arrive at net revenue or are included in operating expenses.

For more information about our revenues, operating income and assets, see “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Item 8. Financial Statements and Supplementary Financial Information” included in this report.

STRATEGY

Our long-term business strategy focuses on increasing our value to casino clients by offering them enhanced services and support, and by producing innovative products and game play methodologies that their players enjoy. We believe that by increasing the value of our products and services to clients, we can continue to build our recurring revenues in both existing and new markets. To achieve this objective, we employ the following strategies:

Expand our portfolio of services, products and technologies. Our strategy is to be an important vendor to casino operators by offering a complete and comprehensive portfolio of services, games, products, systems, technologies and methodologies for casino table games. We continuously develop and/or seek to acquire new proprietary table games to complement our existing offerings and to extend our

5

penetration of proprietary table games on the casino floor. We believe we have a significant opportunity to replicate the success we have had with blackjack side bets by developing content for the other significant public domain casino games of baccarat, roulette and craps.

Increase our per unit revenues by leveraging our Enhanced Table Systems. Our Enhanced Table Systems are placed on tables where we already have our side bet or premium game content deployed. By adding our Enhanced Table Systems, we increase the revenue we earn from that table. Gaming operators deploy the Enhanced Table Systems because they generally increase the win for the casino by an amount that significantly exceeds the cost to license the system from us. Our product strategy includes making Electronic Table Systems that support a multitude of side bets and premium games across several casino game segments (e.g., blackjack, craps, roulette, baccarat, etc.).

Expand the number of markets we serve. We have made continuous efforts to obtain licensure in new markets.

Grow our iGaming content and partner base. We intend to increase our revenues from iGaming in several ways. First, we expect that our existing licensees will see growth in their current markets while adding new markets in the U.S. and elsewhere. Second, we intend to add new licensees in the iGaming segment. And finally, we intend to add to the number of games that we license to both existing and new licensees.

Promote the use of our game content in adjacent gaming markets. We have proprietary table game content that is well-known and popular in physical casinos and online casinos. One example is the Electronic Table Games (“ETG”) market, which offers table game content on touch-screen video devices. As casinos face rising labor costs, traditional table games that require one or more physical dealers can become unprofitable at low bet minimums, and casinos expanded the use of ETGs to address this opportunity. Another example is lotteries (both ticket lotteries and iLotteries), where our well-known game content may attract patrons to lotteries as another way to enjoy it. There may be regulatory restrictions on the use of casino gaming content in certain lottery markets, but the addressable market is incremental even excluding these markets.

COMPETITION

We compete with several companies that develop and provide proprietary table games, electronic gaming platforms, game enhancements and related services. We believe that the principal competitive factors in our market include products and services that appeal to casinos and players, jurisdictional approvals and a well-developed sales and distribution network.

We believe that our success will depend upon our ability to remain competitive in our field. Competition can be based on price, brand recognition, player appeal and the strength of underlying intellectual property and superior customer service. Larger competitors may have longer operating histories, greater brand recognition, more firmly established supply relationships, superior capital resources, wider distribution channels and better product inventory than we do. Smaller competitors may be more able to participate in developing and marketing table games, compared to other gaming products, because of the lower cost and complexity associated with the development of these products and a generally less stringent regulatory environment. We compete with others in efforts to obtain or create innovative products, obtain financing, acquire other gaming companies, and license and distribute products. We compete on these bases, as well as on the strength of our sales, service and distribution channels.

Our land-based competitors include, but are not limited to, Light & Wonder, Inc.; International Game Technology; Play AGS, Inc.; TCS/John Huxley; Aces Up Gaming LLC; and Masque Publishing. Most of these competitors are larger than we are, have more financial resources than we do, have more business segments than we do, and have the ability to combine multiple products and provide discounts in connection with the combinations. In addition, we expect additional competitors to emerge in the future. There can be no assurances that we will be able to compete effectively in the future and failure to compete successfully in the market could have a material adverse effect on our business.

Unlike our land-based operations, we distribute iGaming content from competitors like AGS and select Light & Wonder offerings to partners worldwide. This approach has strengthened our position as a leading global distributor of table games content. To date, we have formed partnerships with some of the world’s largest gaming companies, including, but not limited to Evolution, Pragmatic Play, Playtech, SoftConstruct, Digitain, Bet365, Entain, Flutter, and DraftKings.

6

SUPPLIERS

We own the content for the majority of our Core Side Bets and Premium Games and we license some games from others, to whom we pay royalty fees when we license those games to others (including in the online gaming sector). We generally have multi-year licensing agreements for this content. With respect to our Enhanced Table Systems, we obtain most of the parts for our products from third-party suppliers, including both off-the-shelf items as well as components manufactured to our specifications. We also assemble a small number of parts in-house that are used both for product assembly and for servicing existing products. We generally perform warehousing, quality control, final assembly and shipping functions from our facilities in Las Vegas, Nevada, although small inventories are maintained, and repairs are performed by our remote field service employees.

In our iGaming business, we license some of our game content from third-party providers for re-licensing to online operators along with the content we own outright. We pay royalties to the owners of the content that we license from them.

RESEARCH AND DEVELOPMENT

We seek to develop and maintain a robust pipeline of new products and services to bring to market. We employ a staff of hardware and software engineers, graphic artists and game developers at our corporate offices to support, improve and upgrade our products and to develop and explore other potential table game products, technologies, methodologies and services. We also will use outside services for research and development from time to time.

INTELLECTUAL PROPERTY

Our products and the intellectual property associated with them are typically protected by patents, trademarks, copyrights and non-compete agreements. However, there can be no assurance that the steps we have taken to protect our intellectual property will be sufficient. Further, in the United States certain court rulings may make it difficult to enforce patents around the math relating to casino games, which makes us more dependent on copyrights and trademarks for protection. In addition, the laws of some foreign countries do not protect intellectual property to the same extent as the laws of the United States, which could increase the likelihood of infringement. Furthermore, other companies could develop similar or superior products without violating our intellectual property rights. If we resort to legal proceedings to enforce our intellectual property rights, the proceedings could be burdensome, disruptive, expensive, and distract the attention of management, and there can be no assurance that we would prevail.

We have been subject to litigation claiming that we have infringed the rights of others and/or that certain of our patents and other intellectual property are invalid or unenforceable. We have also brought actions against others to protect our rights.

GOVERNMENT REGULATION

We are subject to regulation by governmental authorities in most jurisdictions in which we offer our products. The development and distribution of casino games, gaming equipment, systems technology and related services, as well as the operation of casinos, are all subject to regulation by a variety of federal, state, international, tribal, and local agencies with the majority of oversight provided by individual state gaming control boards. While the regulatory requirements vary by jurisdiction, most require:

Gaming regulatory requirements vary from jurisdiction to jurisdiction, and obtaining licenses, registrations, findings of suitability for our officers, directors, and principal stockholders and other required approvals with respect to us, our personnel and our products are time consuming and expensive. Generally, gaming regulatory authorities have broad discretionary powers and may deny applications for or revoke approvals on any basis they deem reasonable. We have approvals that enable us to conduct our business in numerous jurisdictions, subject in each case to the conditions of the particular approvals. These conditions may include limitations as to the type of game or product we may sell or lease, as well as limitations on the type of facility, such as riverboats, and the territory within which we may operate, such as tribal nations. Gaming laws and regulations serve to protect the public interest and ensure gambling related activity is conducted honestly, competitively and free of corruption. Regulatory oversight additionally ensures that the local authorities receive the appropriate amount of gaming tax revenues. As such, our financial systems and reporting functions must demonstrate high levels of detail and integrity.

We also have authorizations with certain Native American tribes throughout the United States that have compacts with the states in which their tribal dominions are located or operate or propose to operate casinos. These tribes generally require suppliers of gaming and gaming-related equipment to obtain authorizations. Gaming on Native American lands within the United States is governed by the Federal Indian Gaming Regulatory Act of 1988 (“IGRA”) and specific tribal ordinances and regulations. Class III gaming (table games

7

and slot machines, for example), as defined under IGRA, also requires a Tribal-State Compact, which is a written agreement between a specific tribe and the respective state. This compact authorizes the type of Class III gaming activity and the standards, procedures and controls under which the Class III gaming activity must be conducted. The National Indian Gaming Commission (“NIGC”) has oversight authority over gaming on Native American lands and generally monitors tribal gaming, including the establishment and enforcement of required minimum internal control standards. Each tribe is sovereign and must have a tribal gaming commission or office established to regulate tribal gaming activity to ensure compliance with IGRA, NIGC, and its Tribal-State Compact. We have complied with each of the numerous vendor licensing, specific product approvals and shipping notification requirements imposed by Tribal-State Compacts and enforced by tribal and/or state gaming agencies under IGRA in the Native American lands in which we do business.

The nature of the industry and our worldwide operations make the license application process very time consuming and require extensive resources. We engage legal resources familiar with local customs in certain jurisdictions to assist in keeping us compliant with applicable regulations worldwide. Through this process, we seek to assure both regulators and investors that all our operations maintain the highest levels of integrity and avoid any appearance of impropriety.

We have obtained or applied for all required government licenses, permits, registrations, findings of suitability and approvals necessary to develop and distribute gaming products in all jurisdictions where we directly operate. Although many regulations at each level are similar or overlapping, we must satisfy all conditions individually for each jurisdiction. Additionally, in certain jurisdictions we license our products through distributors authorized to do business in those jurisdictions.

In addition to what may be required of our officers, board members, key employees and substantial interest holders, any of our stakeholders, including but not limited to investors, may be subject to regulatory requests and suitability findings. Failure to comply with regulatory requirements or obtaining a finding of unsuitability by a regulatory body could result in a substantial or total loss of investment.

In the future, we intend to seek the necessary registrations, licenses, approvals, and findings of suitability for us, our products, and our personnel in other jurisdictions throughout the world. However, we may be unable to obtain such necessary items, or if such items are obtained, may be revoked, suspended, or conditioned. In addition, we may be unable to obtain on a timely basis, or to obtain at all, the necessary approvals of our future products as they are developed, even in those jurisdictions in which we already have existing products licensed or approved. If the necessary registrations are not sought after or the required approvals not received, we may be prohibited from selling our products in that jurisdiction or may be required to sell our products through other licensed entities at a reduced profit.

EMPLOYEES

As of December 31, 2024, we had 47 full-time employees, including executive officers, management personnel, accounting personnel, office staff, sales staff, service technicians and research and development personnel. As needed, we also employ part-time and temporary employees and pay for the services of independent contractors.

Available Information

Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports are accessible on our website at https://ir.galaxygaming.com by clicking on the tab labeled “SEC Filings.” These reports are made available, without charge, as soon as is reasonably practicable after we file or furnish them electronically with the Securities and Exchange Commission. The information contained on, or that can be accessed through, our website is not a part of, or incorporated by reference into, this Annual Report on form 10-K.

ITEM 1A. RISK FACTORS

The announcement and pendency of our agreement to be acquired by Parent may have an adverse effect on our business, operating results and our stock price, and may result in the loss of employees, customers, suppliers, and other business partners.

On July 18, 2024, we entered into the Merger Agreement. We are subject to risks in connection with the announcement and pendency of the Merger regardless of whether the Merger is completed, including, but not limited to, the following:

8

The adverse effects of the pendency of the Merger could be exacerbated by any delays in completion of the Merger or termination of the Merger Agreement.

While the Merger is pending, we are subject to contractual restrictions that could harm our business, operating results and our stock price.

The Merger Agreement includes restrictions on the conduct of our business prior to the completion of the Merger, generally requiring us to conduct our businesses in all material respects in the ordinary course of business, to use reasonable best efforts to cooperate in seeking regulatory approvals, and to not engage in certain specified activities without Parent’s prior consent. We may find that these and other obligations in the Merger Agreement may delay or prevent us from or limit our ability to respond effectively to competitive pressures, industry developments and future business opportunities that may arise during such period, even if our management and board of directors think they may be advisable. These restrictions could adversely impact our business, operating results and our stock price and our perceived acquisition value, regardless of whether the Merger is completed.

The failure to complete the Merger within the expected timeframe or at all may adversely affect our business and our stock price.

The consummation of the Merger is subject to a number of closing conditions, including, among other things, the receipt of certain gaming regulatory approvals. There can be no assurance that these conditions to the completion of the Merger will be satisfied, or that the Merger will be completed on the proposed terms, within the expected timeframe or at all. If the Merger is not completed, we may be subject to negative publicity or be negatively perceived by the investment or business communities and our stock price could fall to the extent that our current stock price reflects an assumption that the Merger will be completed. Furthermore, if the Merger is not completed, regardless of the reason, we may suffer other consequences that could adversely affect our business and results of our operations.

The Merger Agreement with Parent limits our ability to pursue alternative transactions which could deter a third party from proposing an alternative transaction.

The Merger Agreement contains provisions that, subject to certain exceptions, limit our ability to initiate, solicit, or knowingly facilitate (including by way of furnishing non-public information) the submission of any inquiries, regarding, or the making of any inquiry, proposal or offer that constitutes, or would reasonably be expected to lead to, a Takeover Proposal (as defined in the Merger Agreement), or take certain other restricted actions in connection therewith. It is possible that these or other provisions in the Merger Agreement might discourage a potential competing acquirer that might have an interest in acquiring all or a significant part of our

9

outstanding common stock from considering or proposing an acquisition or might result in a potential competing acquirer proposing to pay a lower per share price to acquire our common stock than it might otherwise have proposed to pay.

We and our directors may be subject to litigation challenging the Merger, and an unfavorable judgment or ruling in any such lawsuits could prevent or delay the consummation of the Merger and/or result in substantial costs.

Beginning on September 11, 2024, seven purported stockholders of Galaxy have sent demands to the Company, two of which included draft complaints. On October 18, 2024, two purported stockholders filed complaints relating to the Merger Agreement disclosures, captioned Finger v. Galaxy Gaming, Inc., et al., Index No. 655536/2024 (N.Y. Sup. Ct.) and Coffman v. Galaxy Gaming, Inc., et al., Index No. 655530/2024 (N.Y. Sup. Ct.). The demand letters and complaints allege that the definitive proxy statement on Schedule 14A filed by the Company on September 26, 2024, is materially incomplete and misleading because it omitted certain information related to the Merger (as defined herein), including but not limited to information about the Company’s financial projections and analyses performed by Galaxy’s financial advisor, Macquarie Capital (USA) Inc.

Additional lawsuits and demand letters arising out of the Merger may also be filed or received in the future. The outcome of any such demands and complaints and any litigation ensuing from such demands and complaints cannot be assured, including the amount of fees and costs associated with defending these claims or any other liabilities that may be incurred in connection therewith. Whether or not any plaintiff’s claim is successful, this type of litigation can result in significant costs and divert our attention and resources from the Merger and ongoing business activities, which could adversely affect our operations. In addition, if dismissals are not obtained or a settlement is not reached, these lawsuits could prevent or delay completion of the Merger.

ITEM 1B. UNRESOLVED STAFF COMMENTS

A smaller reporting company is not required to provide the information required by this Item.

ITEM 1C. CYBERSECURITY

Risk Management and Strategy

We have developed and implemented cybersecurity risk management processes intended to protect the confidentiality,

Our cybersecurity risk management program includes:

We have not identified risks from known cybersecurity threats, that have materially affected or are reasonably likely to

Governance

Our Board considers cybersecurity risk as part of its risk oversight function.

Our management team supervises efforts to prevent, detect, mitigate, and remediate cybersecurity risks and incidents through various means, which may include briefings from external security personnel; threat intelligence and other information obtained from

10

governmental, public or private sources; and alerts and reports produced by security tools deployed in the information technology environment.

ITEM 2. PROPERTIES

We do not own any real property used in the operation of our current business. We maintain our corporate office at 6480 Cameron Street, Suite 305, Las Vegas, Nevada, where we currently occupy approximately 14,000 square feet of combined office and warehouse space. We also maintain a small warehouse and service facility in Kent, Washington and a small office in Richland, Washington. See Note 8 to our audited financial statements included in Item 8 “Financial Statements and Supplementary Financial Information” for further details.

ITEM 3. LEGAL PROCEEDINGS

We have been named in and have brought lawsuits in the normal course of business. See Note 10 to our audited financial statements included in Item 8 “Financial Statements and Supplementary Financial Information” for further details.

ITEM 4. MINE SAFETY DISCLOSURES

A smaller reporting company is not required to provide the information required by this Item.

11

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

Our common stock is quoted on the OTCQB marketplace (“OTCQB”) under the ticker symbol GLXZ.

The following table sets forth the range of high and low closing sale prices for our common stock for each of the periods indicated as reported by the OTCQB.

|

|

|

|

2024 |

|

|

|

2023 |

|

||||||||||

Quarter Ended |

|

|

High ($) |

|

|

|

Low ($) |

|

|

|

High ($) |

|

Low ($) |

|

|||||

March 31, |

|

|

|

|

1.90 |

|

|

|

|

1.33 |

|

|

|

|

3.15 |

|

|

2.30 |

|

June 30, |

|

|

|

|

1.60 |

|

|

|

|

1.26 |

|

|

|

|

2.70 |

|

|

2.34 |

|

September 30, |

|

|

|

|

2.84 |

|

|

|

|

1.38 |

|

|

|

|

3.05 |

|

|

2.50 |

|

December 31, |

|

|

|

|

2.84 |

|

|

|

|

2.69 |

|

|

|

|

2.90 |

|

|

1.40 |

|

The Securities and Exchange Commission (the “SEC”) has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a market price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the SEC, that: (a) contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; (b) contains a description of the broker’s or dealer’s duties to the customer and of the rights and remedies available to the customer with respect to a violation of such duties or other requirements of the securities laws; (c) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; (d) contains a toll-free telephone number for inquiries on disciplinary actions; (e) defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and (f) contains such other information and is in such form, including language, type size and format, as the SEC shall require by rule or regulation.

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with (a) bid and offer quotations for the penny stock; (b) the compensation of the broker-dealer and its salesperson in the transaction; (c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (d) a monthly account statement showing the market value of each penny stock held in the customer’s account.

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written acknowledgment of the receipt of a risk disclosure statement, a written agreement as to transactions involving penny stocks, and a signed and dated copy of a written suitability statement.

These disclosure requirements may have the effect of reducing the trading activity for our common stock. Therefore, stockholders may have difficulty buying or selling our securities.

HOLDERS OF OUR COMMON STOCK

As of March 4, 2025, we had 25,115,299 shares of our common stock issued and outstanding and 38 stockholders of record. The number of holders of record does not include stockholders for whom shares were held in “nominee” or “street name.”

DIVIDEND POLICY

There are no restrictions in our articles of incorporation or bylaws that prevent us from declaring dividends. The Nevada Revised Statutes, however, do prohibit us from declaring dividends where after giving effect to the distribution of the dividend:

We have not declared any dividends, and we do not plan to declare any dividends in the foreseeable future. Our credit facility impose significant restrictions on our ability to pay dividends.

12

TRANSFER AGENT

Our stock transfer agent and registrar is Pacific Stock Transfer Company located at 6725 Via Austi Parkway, Suite 300, Las Vegas, Nevada, 89119. Their telephone number is (540) 216-0187.

13

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following is a discussion and analysis of our financial condition, results of operations and liquidity and capital resources as of and for the years ended December 31, 2024 and 2023. This discussion should be read together with our audited consolidated financial statements and related notes included in Item 8. Financial Statements and Supplementary Financial Information. Some of the information contained in this discussion includes forward-looking statements that involve risks and uncertainties; therefore our “Special Note Regarding Forward-Looking Statements” should be reviewed for a discussion of important factors that could cause actual results to differ materially from the results described in, or implied by, such forward-looking statements.

OVERVIEW

We develop, acquire, assemble and market technology and entertainment-based products and services for the gaming industry for placement on casino floors and on legal internet gaming sites. Our products and services primarily relate to licensed casino operators’ table games activities and focus on either increasing their profitability and productivity or expanding their gaming entertainment offerings in the form of proprietary table games, electronically enhanced table game platforms, fully-automated electronic tables and other ancillary equipment. In addition, we license intellectual property to legal internet gaming operators. Our products and services are offered in various highly regulated markets and certain non-regulated (where such is not illegal) markets throughout the world. Our products are assembled at our headquarters in Las Vegas, Nevada, as well as outsourced for certain sub-assemblies in the United States.

Agreement and Plan of Merger with Evolution

On July 18, 2024, we entered into the Merger Agreement providing for the Company’s acquisition by Evolution Malta Holding Limited in a cash transaction. The Merger is subject to the satisfaction or waiver of certain closing conditions, including approval by at least a majority of the voting power of the outstanding shares of the Company’s common stock of the Merger Agreement and the transactions contemplated thereby, including the Merger, and the receipt of certain gaming regulatory approvals. At the special meeting of the Company’s stockholders held on November 12, 2024, stockholders voted to approve the Merger. The Merger is expected to be completed in mid-2025, subject to satisfaction or waiver of the closing conditions. Upon completion of the Merger, the Company will become a privately held company and shares of Company’s common stock will no longer be listed on any public market.

14

Results of operations for the years ended December 31, 2024 and 2023.

Our net revenue consists of the following components:

|

Twelve Months Ended December 31, |

|

|

|

|

|

|

|

|||||||

|

2024 |

|

|

2023 |

|

|

$ Change |

|

|

% Change |

|

||||

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

||||

Core Revenues: |

|

|

|

|

|

|

|

|

|

|

|

||||

Recurring License Revenue |

$ |

21,028,970 |

|

|

$ |

16,727,597 |

|

|

$ |

4,301,373 |

|

|

|

25.7 |

% |

Perpetual License Sales of Progressive Gaming Systems |

|

3,502,053 |

|

|

|

3,625,357 |

|

|

|

(123,304 |

) |

|

|

-3.4 |

% |

Gross Revenue |

|

24,531,023 |

|

|

|

20,352,954 |

|

|

|

4,178,069 |

|

|

|

20.5 |

% |

Royalties Netted against Gross Revenue |

|

(3,143,931 |

) |

|

|

(996,665 |

) |

|

|

(2,147,266 |

) |

|

|

215.4 |

% |

Total Core Revenue |

$ |

21,387,092 |

|

|

$ |

19,356,289 |

|

|

$ |

2,030,803 |

|

|

|

10.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Digital Revenues: |

|

|

|

|

|

|

|

|

|

|

|

||||

Recurring License Revenue |

$ |

14,283,982 |

|

|

$ |

11,378,918 |

|

|

$ |

2,905,064 |

|

|

|

25.5 |

% |

Gross Revenue |

|

14,283,982 |

|

|

|

11,378,918 |

|

|

|

2,905,064 |

|

|

|

25.5 |

% |

Royalties Netted against Gross Revenue |

|

(3,933,608 |

) |

|

|

(2,946,123 |

) |

|

|

(987,485 |

) |

|

|

33.5 |

% |

Total Digital Revenue |

$ |

10,350,374 |

|

|

$ |

8,432,795 |

|

|

$ |

1,917,579 |

|

|

|

22.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Consolidated Revenues: |

|

|

|

|

|

|

|

|

|

|

|

||||

Recurring License Revenue |

$ |

35,312,952 |

|

|

$ |

28,106,515 |

|

|

$ |

7,206,437 |

|

|

|

25.6 |

% |

Perpetual License Sales of Progressive Gaming Systems |

|

3,502,053 |

|

|

|

3,625,357 |

|

|

|

(123,304 |

) |

|

|

-3.4 |

% |

Gross Revenue |

|

38,815,005 |

|

|

|

31,731,872 |

|

|

|

7,083,133 |

|

|

|

22.3 |

% |

Royalties Netted against Gross Revenue |

|

(7,077,539 |

) |

|

|

(3,942,788 |

) |

|

|

(3,134,751 |

) |

|

|

79.5 |

% |

Revenue |

$ |

31,737,466 |

|

|

$ |

27,789,084 |

|

|

$ |

3,948,382 |

|

|

|

14.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Costs and expenses |

|

|

|

|

|

|

|

|

|

|

|

||||

Cost of ancillary products and assembled components |

$ |

1,509,776 |

|

|

$ |

1,263,271 |

|

|

$ |

246,505 |

|

|

|

19.5 |

% |

Selling, general and administrative |

|

19,685,457 |

|

|

|

15,676,628 |

|

|

|

4,008,829 |

|

|

|

25.6 |

% |

Research and development |

|

1,057,183 |

|

|

|

823,189 |

|

|

|

233,994 |

|

|

|

28.4 |

% |

Depreciation and amortization |

|

2,863,507 |

|

|

|

2,274,461 |

|

|

|

589,046 |

|

|

|

25.9 |

% |

Stock-based compensation |

|

919,649 |

|

|

|

1,021,953 |

|

|

|

(102,304 |

) |

|

|

-10.0 |

% |

Total costs and expenses |

|

26,035,572 |

|

|

|

21,059,502 |

|

|

|

4,976,070 |

|

|

|

23.6 |

% |

Income from operations |

|

5,701,894 |

|

|

|

6,729,582 |

|

|

|

(1,027,688 |

) |

|

|

-15.3 |

% |

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

||||

Interest income |

|

780,933 |

|

|

|

611,271 |

|

|

|

169,662 |

|

|

|

27.8 |

% |

Interest expense |

|

(9,066,203 |

) |

|

|

(9,063,112 |

) |

|

|

(3,091 |

) |

|

|

0.0 |

% |

Foreign currency exchange gain (loss) |

|

13,913 |

|

|

|

(6,099 |

) |

|

|

20,012 |

|

|

|

-328.1 |

% |

Total other income (expense), net |

|

(8,271,357 |

) |

|

|

(8,457,940 |

) |

|

|

186,583 |

|

|

|

-2.2 |

% |

Loss before provision for income taxes |

$ |

(2,569,463 |

) |

|

$ |

(1,728,358 |

) |

|

$ |

(841,105 |

) |

|

|

48.7 |

% |

Provision for income taxes |

|

(57,647 |

) |

|

|

(79,228 |

) |

|

|

21,581 |

|

|

|

-27.2 |

% |

Net loss |

$ |

(2,627,110 |

) |

|

$ |

(1,807,586 |

) |

|

$ |

(819,524 |

) |

|

|

45.3 |

% |

Revenue

Recurring core revenue increased $4,301,373, or 25.7% for the twelve months ended December 31, 2024, as compared to the same period in the prior year. This growth was primarily driven by favorable revenue from our EZ Baccarat distribution arrangement, which began in September 2023, along with the continued success of our side bets and progressive products. Royalties netted against gross core revenue increased $2,147,266 for the twelve months ended December 31, 2024, as compared to the same period in the prior year. This increase was attributable to royalties paid on our EZ Baccarat revenues. Perpetual license sales of our progressive gaming systems was $3,502,053, representing a 3.4% percent decrease for the twelve months ended December 31, 2024, as compared to the same period in the prior year. Gross digital revenues of $14,283,982, increased $2,905,064, or 25.5% for the twelve months ended December 31, 2024, as compared to the same period in the prior year. This favorable growth reflects the ongoing expansion of digital content into new markets and the continued success of our competitive branded products, particularly the well-known 21+3. Net of royalties, digital

15

revenues increased to $1,917,579, representing growth of 22.7% for the twelve months ended December 31, 2024, as compared to the same period in the prior year.

Cost and Expenses

Cost of ancillary products and assembled component expense increased $246,505, or 19.5% for the twelve months ended December 31, 2024, as compared to the same period in the prior year. This increase is primarily driven by product mix, with a larger proportion of lower-margin items sold. Additionally, there was a secondary impact from higher component costs related to the perpetual license sales of our progressive gaming systems.

Selling, general and administrative expenses increased $4,008,829, or 25.6% for the twelve months ended December 31, 2024, as compared to the same period in the prior year. This change was due to expenses associated with special projects of $3,489,955, notably legal expenses incurred related to the acquisition by Evolution and to a lesser extent driven by higher internal labor and related expenses (base salary, commissions, payroll-related taxes, bonus accrual and travel), increased repair and maintenance costs of leased machines, and increased information technology costs. Without the costs associated with the acquisition by Evolution and excluding the related transaction fees of $3,489,955, selling, general, and administrative expenses increased $518,874, or 3% for the twelve months ended December 31, 2024, as compared to the same period in the prior year.

Research and development expenses for the twelve months ended December 31, 2024, were $1,057,183 compared to $823,189 for the comparable prior-year period, representing an increase of $233,994, or 28.4%. This increase was driven by higher payroll costs due to increased headcount, employee bonuses, and the ongoing development of internal software placed in service.

Depreciation and amortization increased $589,046, or 25.9% for the twelve months ended December 31, 2024, as compared to the same period in the prior year. This increase was primarily driven by depreciation expense associated with incremental placements of assets deployed at client locations.

Stock-based compensation expenses decreased 10.0% for the twelve months ended December 31, 2024, as compared to the same period in the prior year. The decrease was primarily due to changes in the level and composition of stock-based compensation paid to members of our Board of Directors in 2024, which included a reduction in the number of board members for part of the year. Additionally, lower stock-based compensation for employees and consultants contributed to the decline.

Interest expense remained relatively flat at $9,066,203 for the twelve months ended December 31, 2024, as compared to interest expense of $9,063,112 for the comparable prior-year period. Interest income increased 27.8% compared to the prior year period, benefitting from higher cash balances and interest rate fluctuations.

Income tax provision was $57,647 for the twelve months ended December 31, 2024, compared to income tax provision of $79,228 for the comparable prior-year period. The decrease in expense is primarily driven by the increase in loss before provision for income taxes.

Primarily as a result of the factors described above, we had a net loss of $2,627,110 for the twelve months ended December 31, 2024, as compared to a net loss of approximately $1,807,586 for the same period in the prior year.

16

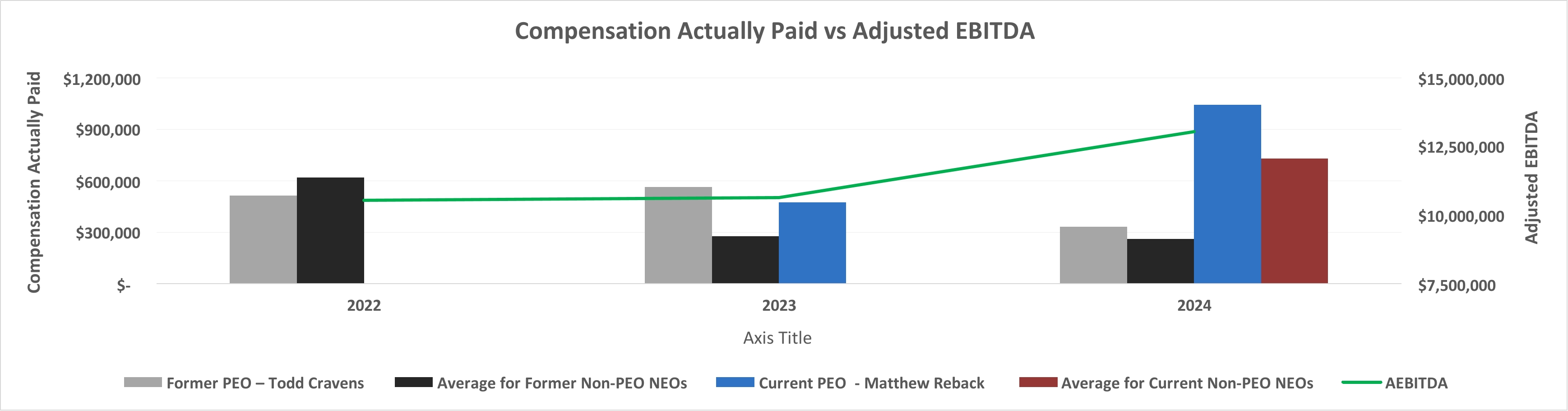

Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”). Adjusted EBITDA includes adjustments to net loss to exclude interest, income taxes, depreciation, amortization, stock-based compensation, foreign currency exchange (gain), and severance and other expenses related to litigation. Adjusted EBITDA is not a measure of performance defined in accordance with U.S. Generally Accepted Accounting Principles (“U.S. GAAP”). However, Adjusted EBITDA is used by management to evaluate our operating performance. Management believes that disclosure of the Adjusted EBITDA metric offers investors, regulators and other stakeholders a view of our operations in the same manner management evaluates our performance. When combined with U.S. GAAP results, management believes Adjusted EBITDA provides a comprehensive understanding of our financial results. Adjusted EBITDA should not be considered as an alternative to net income or (loss) to net cash provided by operating activities as a measure of operating results or of liquidity. It may not be comparable to similarly titled measures used by other companies, and it excludes financial information that some may consider important in evaluating our performance. A reconciliation of "U.S. GAAP" net income to Adjusted EBITDA is as follows:

|

|

Year Ended December 31, |

|

|||||

Adjusted EBITDA Reconciliation: |

|

2024 |

|

|

2023 |

|

||

Net loss |

|

$ |

(2,627,110 |

) |

|

$ |

(1,807,586 |

) |

Interest expense |

|

|

9,066,203 |

|

|

|

9,063,112 |

|

Interest income |

|

|

(780,933 |

) |

|

|

(611,271 |

) |

Provision for income taxes |

|

|

57,647 |

|

|

|

79,228 |

|

Depreciation and amortization |

|

|

2,863,507 |

|

|

|

2,274,461 |

|

EBITDA |

|

|

8,579,314 |

|

|

|

8,997,944 |

|

Stock-based compensation (1) |

|

|

919,649 |

|

|

|

1,021,953 |

|

Employee severance costs and other expenses (2) |

|

|

24,482 |

|

|

|

474,798 |

|

CEO transition expenses (3) |

|

|

8,200 |

|

|

|

128,106 |

|

Professional fees, acquisition costs and other (4) |

|

|

3,489,955 |

|

|

|

5,969 |

|

Loss on disposal of assets (5) |

|

|

33,245 |

|

|

|

— |

|

Foreign exchange (gain) loss (6) |

|

|

(13,913 |

) |

|

|

6,099 |

|

Adjusted EBITDA |

|

$ |

13,040,932 |

|

|

$ |

10,634,869 |

|

(1) Represents the non-cash expense associated with the value of equity awards granted to employees, directors and consultants by the Company.

(2) Represents costs associated with the severance of employees.

(3) Represents Company reimbursed moving expenses incurred by the new President and CEO, Matthew Reback.

(4) Represents professional fees and transaction related fees incurred related to acquisitions, mergers and professional fees incurred for other projects not considered part of the normal course of business.

(5) Represents non-cash charge related to the write off of certain fixed assets.

(6) Represents foreign exchange losses and gains associated with the fluctuations of foreign currency rates.

Liquidity and capital resources. We have generally been able to fund our continuing operations, our investments, and the obligations under our existing borrowings through cash flow from operations. We may require additional capital to undertake acquisitions or to repay in full our indebtedness. Our ability to access capital for operations or for acquisitions will depend on conditions in the capital markets and investors’ perceptions of our business prospects and such conditions and perceptions may not always favor us.

As of December 31, 2024, we had total current assets of $24,171,920 and total assets of $41,010,731. As of December 31, 2023, we had total current assets of $22,156,035 and total assets of $40,475,800. The increase in current assets as of December 31, 2024, compared to December 31, 2023, was due to the increased cash and cash equivalents driven by cash provided by operating activities and increased accounts receivable. The increase in total assets as of December 31, 2024, compared to December 31, 2023, was primarily due to the increase of current assets noted above and offset by a decrease in other intangible assets and operating lease right-of-use assets as a result of amortization in 2024.

Our total current liabilities as of December 31, 2024, increased to $6,602,744 from $4,875,967 as of December 31, 2023, primarily due to an increase in accounts payable related to professional fees in connection with the acquisition by Evolution.

Based on our current forecast of operations, we believe we will have sufficient liquidity to fund our operations and to meet the obligations under our financing arrangements as they come due over at least the next 12 months.

We continue to file applications for new or enhanced licenses in several jurisdictions, which may result in significant future legal and regulatory expenses. A significant increase in such expenses may require us to postpone growth initiatives or investments in personnel, inventory and research and development of our products. It is our intention to continue such initiatives and investments.

17

Our operating activities provided cash of $4,098,634 for the year ended December 31, 2024, compared to cash provided of $2,729,477 for the year ended December 31, 2023. This change is attributable to a favorable variance of $1,726,976 in use of assets and liabilities that relate to operations. Additionally, depreciation and amortization increased $589,046 related to increased capitalization of intangible assets and offset by a $102,304 decline in stock-based compensation from the vesting of stock options and a $70,862 decrease in reserve for credit losses.

Investing activities used cash of $1,622,604 for the year ended December 31, 2024, and $2,955,681 for the year ended December 31, 2023. This decrease in cash used was primarily due to the increase in the transfer of title of assets deployed at client locations to perpetual license customers in conjunction with a decrease in cash used for the acquisition of assets deployed.

Cash used in financing activities for the year ended December 31, 2024, was $886,126. This compares to $1,367,304 cash used by financing activities for the twelve months ended December 31, 2023. The decrease in cash used was primarily due to the absence of principal payments on our borrowings based on the "Excess Cash Flow" calculation as defined by the terms in the Fortress Credit Agreement (Note 9), in the 2024 period.

Credit Facility. In November 2021, we entered into a $60,000,000 senior secured term loan agreement. Subsequent to December 31, 2024, we entered into a new credit agreement that provides for a $2,000,000 senior secured revolving credit facility and a $45,000,000 senior secured term loan. On January 6, 2025, we borrowed $45,000,000 under the new term loan and used this amount plus cash on hand to repay all amounts outstanding under the previous term loan agreement, which was terminated.

Critical Accounting Policies. Our consolidated financial statements have been prepared in accordance with U.S. GAAP. We consider the following accounting policies to be the most important to understanding and evaluating our financial results.

Revenue recognition. We account for our revenue in accordance with Accounting Standards Codification Topic 606, Revenue from Contracts with Customers. We generate revenue primarily from the licensing of our intellectual property. We recognize revenue under recurring fee license contracts monthly as we satisfy our performance obligation, which consists of granting the customer the right to use our intellectual property. Amounts billed are determined based on flat rates or usage rates stipulated in the customer contract.

We sell the perpetual right to use our intellectual property, and from time to time, sell the units used to deliver the gaming systems. Control transfers and we recognize revenue at a point in time when the gaming system is available for use by a customer, which is no earlier than the shipment of the products to the customer or an intermediary for the customer.

Off-balance sheet arrangements. As of December 31, 2024, there were no off-balance sheet arrangements.

Recently issued accounting pronouncements. We do not expect the adoption of recently issued accounting pronouncements to have a significant impact on our results of operations, financial position or cash flow.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

A smaller reporting company is not required to provide the information required by this Item.

18

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY FINANCIAL INFORMATION

INDEX TO FINANCIAL STATEMENTS

Report of Independent Registered Public Accounting Firm, (Moss Adams LLP, San Diego, CA, PCAOB ID: |

|

20 |

Consolidated Balance Sheets as of December 31, 2024 and 2023 |

|

21 |

|

22 |

|

|

23 |

|

Consolidated Statements of Cash Flows for the years ended December 31, 2024 and 2023 |

|

24 |

|

25 |

19

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and the Board of Directors of

Galaxy Gaming, Inc.

Opinion on the Financial Statements

We have audited the accompanying consolidated balance sheets of Galaxy Gaming, Inc. (the “Company”) as of December 31, 2024 and 2023, the related consolidated statements of operations and comprehensive loss, stockholders’ deficit and cash flows for the years then ended, and the related notes (collectively referred to as the “consolidated financial statements”). In our opinion, the consolidated financial statements present fairly, in all material respects, the consolidated financial position of the Company as of December 31, 2024 and 2023, and the consolidated results of its operations and its cash flows for the years then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s consolidated financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the consolidated financial statements, whether due to error or fraud, and performing procedures to respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. We believe that our audits provide a reasonable basis for our opinion.

Critical Audit Matters

Critical audit matters are matters arising from the current period audit of the consolidated financial statements that were communicated or required to be communicated to the audit committee and that (1) relate to accounts or disclosures that are material to the financial statements and (2) involved our especially challenging, subjective, or complex judgments. We determined that there are no critical audit matters.

/s/

March 21, 2025

We have served as the Company’s auditor since 2020.

20

GALAXY GAMING, INC.

CONSOLIDATED BALANCE SHEETS

DECEMBER 31, 2024 AND 2023

ASSETS |

|

December 31, |

|

|

December 31, |

|

||

Current assets: |

|

|

|

|

|

|

||

Cash and cash equivalents |

|

$ |

|

|

$ |

|

||

Accounts receivable, net of allowance of $ |

|

|

|

|

|

|

||

Income tax receivable |

|

|

|

|

|

|

||

Prepaid expenses |

|

|

|

|

|

|

||

Total current assets |

|

|

|

|

|

|

||

Property and equipment, net |

|

|

|

|

|

|

||

Operating lease right-of-use assets |

|

|

|

|

|

|

||

Assets deployed at client locations, net |

|

|

|

|

|

|

||

Goodwill |

|

|

|

|

|

|

||

Other intangible assets, net |

|

|

|

|

|

|

||

Other assets |

|

|

|

|

|

|

||

Total assets |

|

$ |

|

|

$ |

|

||

LIABILITIES AND STOCKHOLDERS’ DEFICIT |

|

|

|

|

|

|

||

Current liabilities: |

|

|

|

|

|

|

||

Accounts payable |

|

$ |

|

|

$ |

|

||

Accrued expenses |

|

|

|

|

|

|

||

Revenue contract liability |

|

|

— |

|

|

|

|

|

Current portion of operating lease liabilities |

|

|

|

|

|

|

||

Current portion of long-term debt |

|

|

|

|

|

|

||

Total current liabilities |

|

|

|

|

|

|

||

Long-term operating lease liabilities |

|

|

|

|

|

|

||

Long-term debt and liabilities, net |

|

|

|

|

|

|

||

Deferred tax liabilities, net |

|

|

|

|

|

|

||

Total liabilities |

|

|

|

|

|

|

||

|

|

|

|

|

|

|||

Stockholders’ deficit |

|

|

|

|

|

|

||

Preferred stock, |

|

|

|

|

|

|

||

Common stock, |

|

|

|

|

|

|

||