Exhibit 99.1

Galaxy Gaming Reports Q3 2022 Financial Results

LAS VEGAS, November 14, 2022 (GLOBE NEWSWIRE) -- Galaxy Gaming, Inc. (OTCQB: GLXZ), a developer and distributor of casino table games and enhanced systems for land-based casinos and iGaming content, announced today its financial results for the quarter and nine months ended September 30, 2022.

Financial Highlights

Q3 2022 vs. Q3 2021

9 Months 2022 vs. 9 Months 2021

Balance Sheet Changes (vs. December 31, 2021)

Executive Comments

“Despite the continued strengthening of the US dollar, we had an excellent quarter,” said Todd Cravens, President and CEO. “On a constant currency basis, revenue increased by 19% in the quarter and 27% in the first nine months vs. the same periods in 2021. As compared to Q2 2022, sequential revenue growth was 6% on a constant currency basis. But the most newsworthy event happened after the end of the quarter at G2E – the gaming show held annually in Las Vegas. We introduced several new games and new technologies that were very well received by clients. In fact, we already have several commitments to trial some of these new products.

“Finally, at the end of the quarter, in consideration of a $2 million cash payment, we eliminated the obligation to make contingent consideration payments to the original seller of the intellectual property supporting our Bonus CrapsTM side bet. Based on the run rate in Q3, this should save us around $315K on an annual basis and potentially more as Bonus Craps deployments increase.”

Exhibit 99.1

“Exchange rates, interest rates and inflation rates worsened in Q3,” stated Harry Hagerty, Galaxy’s CFO. “The dollar continued to appreciate versus the Euro and the British Pound, and the floating rate upon which our interest expense is calculated increased by 138 basis points in the quarter. Inflation continues to affect us as most of our expenses are denominated in US dollars, and the current quarter reflects a higher-than-normal level of professional services expenses as we strengthen our financial systems and our intellectual property protection. But despite the challenges, the Company is performing well, as Todd’s comments about revenue in constant currency and our G2E performance attest. Our balance sheet improved in the quarter with increased cash balances and modestly reduced debt balances, and we were comfortably in compliance with the financial covenant in our Fortress credit agreement.

“The worsening rates environment requires us to modestly modify our guidance for the remainder of the current year,” Hagerty added. “We now forecast revenue in the midpoint of the previously expressed range of $22.5-$23.5 million and Adjusted EBITDA at the low end of the previously expressed range of $10-11 million. This forecast assumes no new lockdowns from COVID-19 or the equivalent, no worsening of the impact to our business from the war in Ukraine, and no economic recession.”

On November 11, 2022, the Board of Directors reauthorized repurchases of the Company’s common stock of up to $750,000, subject to the Company remaining in compliance with the provisions of the Term Loan Credit Agreement and, in particular, the $750,000 restricted payments basket.

Forward-Looking Statements

This press release contains, and oral statements made from time to time by our representatives may contain, forward-looking statements based on management's current expectations and projections, which are intended to qualify for the safe harbor of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include statements identified by words such as "believe," "will," "may," "might," "likely," "expect," "anticipates," "intends," "plans," "seeks," "estimates," "believes," "continues," "projects" and similar references to future periods, or by the inclusion of forecasts or projections. All forward-looking statements are based on current expectations and projections of future events.

These forward-looking statements reflect the current views, models, and assumptions of Galaxy Gaming, and are subject to various risks and uncertainties that cannot be predicted or qualified and could cause actual results in Galaxy Gaming's performance to differ materially from those expressed or implied by such forward looking statements. These risks and uncertainties include, but are not limited to, the ability of Galaxy Gaming to enter and maintain strategic alliances, product placements or installations, in land based casinos or grow its iGaming business, garner new market share, secure licenses in new jurisdictions or maintain existing licenses, successfully develop or acquire and sell proprietary products, comply with regulations, have its games approved by relevant jurisdictions, and other factors. All forward-looking statements made herein are expressly qualified in their entirety by these cautionary statements and there can be no assurance that the actual results, events, or developments referenced herein will occur or be realized. Readers are cautioned that all forward-looking statements speak only to the facts and circumstances present as of the date of this press release. Galaxy Gaming

Exhibit 99.1

expressly disclaims any obligation to update or revise any forward-looking statements, whether because of new information, future events or otherwise.

About Galaxy Gaming

Headquartered in Las Vegas, Nevada, Galaxy Gaming (galaxygaming.com) develops and distributes innovative proprietary table games, state-of-the-art electronic wagering platforms and enhanced bonusing systems to land-based, riverboat, and cruise ship and casinos worldwide. In addition, through its wholly owned subsidiary, Progressive Games Partners LLC, Galaxy licenses proprietary table games content to the online gaming industry. Connect with Galaxy on Facebook, YouTube and Twitter.

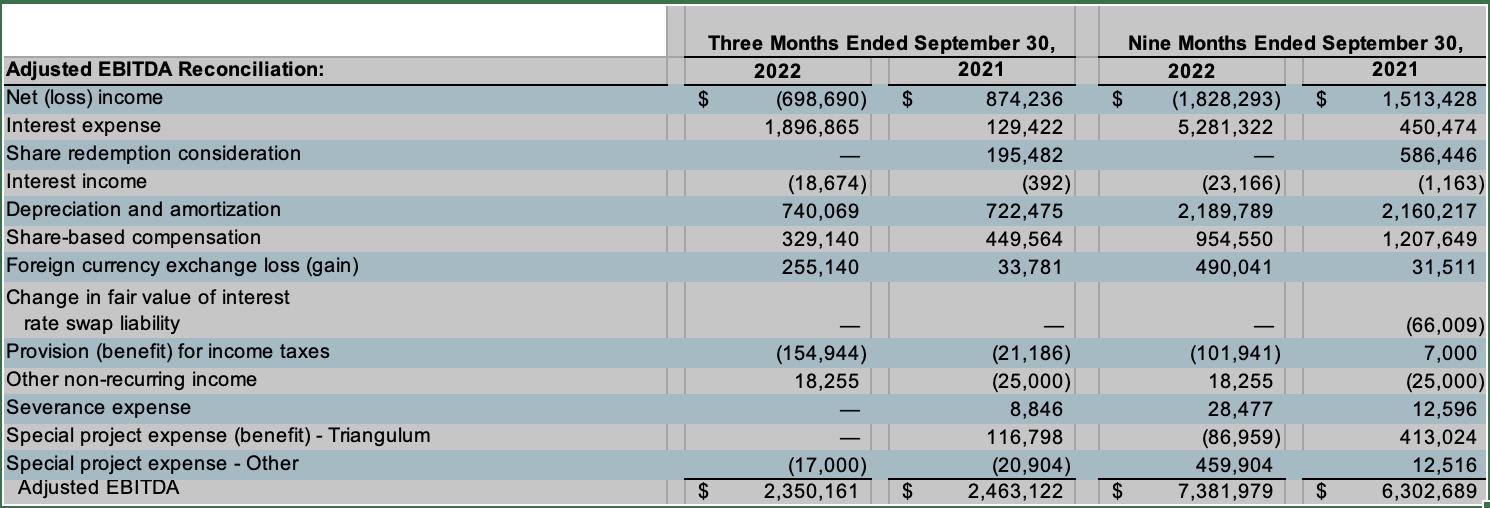

Non-GAAP Financial Information

Adjusted EBITDA includes adjustments to net loss/income to exclude interest, taxes, depreciation, amortization, share based compensation, gain/loss on extinguishment of debt, foreign currency exchange gains/losses, change in estimated fair value of interest rate swap liability and severance and other expenses related to litigation. Adjusted EBITDA is not a measure of performance defined in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP”). However, Adjusted EBITDA is used by management to evaluate our operating performance. Management believes that disclosure of Adjusted EBITDA allows investors, regulators, and other stakeholders to view of our operations in the way management does. Adjusted EBITDA should not be considered as an alternative to net income or to net cash provided by operating activities as a measure of operating results or of liquidity. Finally, Adjusted EBITDA may not be comparable to similarly titled measures used by other companies.

Contact:

Media: Phylicia Middleton (702) 936-5216

Investors: Harry Hagerty (702) 938-1740