Exhibit 99.1

Galaxy Gaming Reports Q2 2023 Financial Results

LAS VEGAS, Aug. 14, 2023 (GLOBE NEWSWIRE) -- Galaxy Gaming, Inc. (OTCQB: GLXZ),

a developer and distributor of casino table games and enhanced systems for land-based casinos and iGaming content, announced today its financial results for the quarter and six months ended June 30, 2023.

Financial Highlights Q2 2023 vs. Q2 2022

1H 2023 vs. 1H 2022

Balance Sheet Changes (vs. December 31, 2022)

1 Includes current portion.

Executive Comments

“Q2 2023 was a record quarter for us in revenue, adjusted EBITDA and cash on hand,” said Todd Cravens, President and CEO. “But Q2 was meaningful for more than just the numbers. We announced a ten-year agreement with Evolution, cementing the relationship with our largest customer well into future. We also announced that, in September, we will become the exclusive distributor for EZ Baccarat® in the US, Canada, the UK and online, an opportunity that we think can generate several million dollars in new revenue for us. And after the quarter, we saw the first installations of our GOS platform in the US and UK and we are very pleased with the results. It has been a very busy six months for us and I want to publicly thank all my fellow Galaxians for their loyalty and dedication.”

“Consistent with Q1, perpetual license sales to a single GG Core customer were $1.6 million in Q2,” said Harry Hagerty, CFO. “Excluding those sales, revenue in GG Core was $3.8 million in Q2 23 as compared to $3.7 million in Q2 22. In GG Digital, revenue (net) was $2.2 million in Q2 23 as compared to $1.9 million in Q2 22.

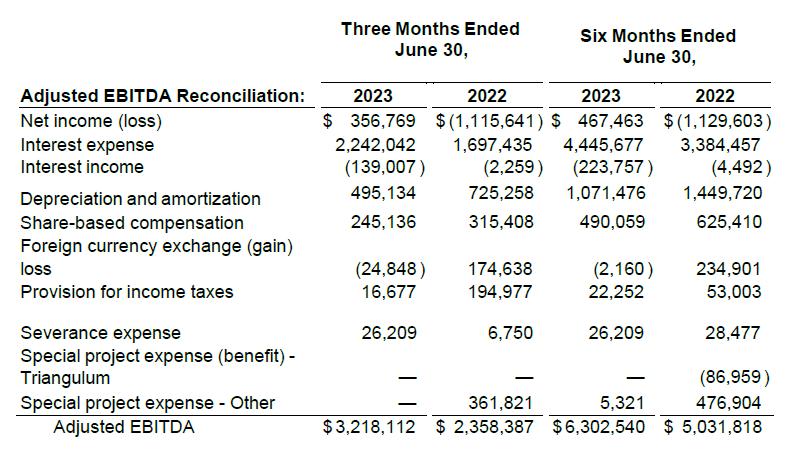

“Our liquidity is good,” Hagerty continued. “At quarter-end, cash was $18.7 million and our long-term debt was $58.6 million. Adjusted EBITDA of $3.2 million was well in excess of the $1.9 million in cash interest in the quarter. Our loan from Fortress Credit Corp. requires our net leverage not to exceed 6.0x at any of the quarter-ends in 2023, and at the end of Q2 we were at 3.4x, comfortably in compliance. It remains our intention to refinance our debt, but conditions in the bank market are less robust than they were at the beginning of the year. Our centerline plan is to continue to reduce our net leverage so that we can be ready to act when the bank market improves.

“With respect to fiscal 2023, we are increasing our guidance for revenue (net of iGaming royalties) from a range of $27.5-$28.5 million to a range of $29-$30 million, and we are increasing the guidance for Adjusted EBITDA to the high end of the previously announced range of $13.0-13.25 million. We expect significantly reduced sales of perpetual licenses in the second half of 2023, offset by increased revenue from our GOS installations as well as from EZ Baccarat placements. This forecast assumes no impact to our business from the war in Ukraine, and no economic recession. Finally, the forecast is based on currency exchange rates that we experienced in the second quarter.”

The company will update its investor deck to reflect the results this quarter. Investors are encouraged to send questions to management at investors@galaxygaming.com by Wednesday, August 16. Management will post their answers to investors on August 23.

Forward-Looking Statements

This press release contains, and oral statements made from time to time by our representatives may contain, forward-looking statements based on management's current expectations and projections, which are intended to qualify for the safe harbor of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include statements identified by words such as "believe," "will," "may," "might," "likely," "expect," "anticipates," "intends," "plans," "seeks," "estimates," "believes," "continues," "projects" and similar references to future periods, or by the inclusion of forecasts or projections. All forward-looking statements are based on current expectations and projections of future events.

These forward-looking statements reflect the current views, models, and assumptions of Galaxy Gaming, and are subject to various risks and uncertainties that cannot be predicted or qualified and could cause actual results in Galaxy Gaming's performance to differ materially from those expressed or implied by such forward looking statements. These risks and uncertainties include, but are not limited to, the ability of Galaxy Gaming to enter and maintain strategic alliances, product placements or installations, in land based casinos or grow its iGaming business, garner new market share, secure licenses in new jurisdictions or maintain existing licenses, successfully develop or acquire and sell proprietary products, comply with regulations, have its games approved by relevant jurisdictions, and adapt to changes resulting from the COVID-19 pandemic and other factors. All forward-looking statements made herein are expressly qualified in their entirety by these cautionary statements and there can be no assurance that the actual results, events, or developments referenced herein will occur or be realized. Readers are cautioned that all forward-looking statements speak only to the facts and circumstances present as of the date of this press release. Galaxy Gaming expressly disclaims any obligation to update or revise any forward- looking statements, whether because of new information, future events or otherwise.

About Galaxy Gaming

Headquartered in Las Vegas, Nevada, Galaxy Gaming (galaxygaming.com) develops and distributes innovative proprietary table games, state-of-the-art electronic wagering platforms and enhanced bonusing systems to land-based, riverboat, and cruise ship and casinos worldwide. In addition, through its wholly owned subsidiary, Progressive Games Partners LLC, Galaxy licenses proprietary table games content to the online gaming industry.

Connect with Galaxy on Facebook, YouTube and Twitter.

Non-GAAP Financial Information

Adjusted EBITDA includes adjustments to net loss/income to exclude interest, taxes, depreciation, amortization, share based compensation, gain/loss on extinguishment of debt, foreign currency exchange gains/losses, change in estimated fair value of interest rate swap liability and severance and other expenses related to litigation. Adjusted EBITDA is not a measure of performance defined in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP”). However, Adjusted EBITDA is used by management to evaluate our operating performance. Management believes that disclosure of Adjusted EBITDA allows investors, regulators, and other stakeholders to view our operations in the way management does. Adjusted EBITDA should not be considered as an alternative to net income or to net cash provided by operating activities as a measure of operating results or of liquidity. Finally, Adjusted EBITDA may not be comparable to similarly titled measures used by other companies.

Contact:

Media: Phylicia Middleton (702) 936-5216

Investors: Harry Hagerty (702) 938-1740

Source: Galaxy Gaming, Inc.